VER’s return on investment 3.7% during 1 Jan–30 June 2023; ten-year average annual return 5.6%

Published 2023-08-30 at 18:11

INVESTMENT ENVIRONMENT

The economic situation remained stable during the first half of the year, despite the diverse challenges posed by higher inflation and interest rates. There were fears that the economy would drift into recession under the impact of inflation and, in particular, rising interest rates. Steps were taken both in the USA and Europe to tighten monetary policy throughout the first half of the year and market interest rates remained at elevated levels. VER’s investment performance was sound during the first six months of 2023. The rise in interest rates also led to a clearly positive return on fixed income investments.

The US Federal Reserve and the European Central Bank (ECB) raised interest rates to curb economic growth and keep inflation down and inflation expectations in check. Despite this, economic growth remained moderate, but corporate performance deteriorated in many areas towards the end of the reporting period. Challenges were visible in the real estate sector, where higher financing costs and changing needs for office space eroded interest in new construction.

In March 2023, regional banks in the United States experienced a bank run. Underlying this turn of events was the overall increase in interest rates, which had an adverse impact on the value of the securities held by these banks. Investors did not wake up to this until March 2023. The US authorities adopted a range of rescue measures, which calmed the markets and prevented the crisis from spreading. The financial performance of banks improved as higher interest rates were reflected in loan rates, but not to the same extent in deposit rates.

The European energy markets regained equilibrium after a mild winter and major restructuring. Energy did not turn into such a major problem as feared in the previous year. The green transition has gained momentum, accompanied by substantial investments in wind power. In Finland, the Olkiluoto 3 nuclear power plant unit came on stream in April, which will improve energy self-sufficiency in the future.

Geopolitical tensions persist without any prospects for a solution to Russia's aggression and a way out of the war. The conflict has spurred interest in the defence industry with military spending increasing in the East and West. Geopolitics will continue to play a role in assessing the attractiveness of individual economies as investment targets.

VER’S RETURN ON INVESTMENTS

Future monitoring and evaluation of the VER’s investment activities will focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments.

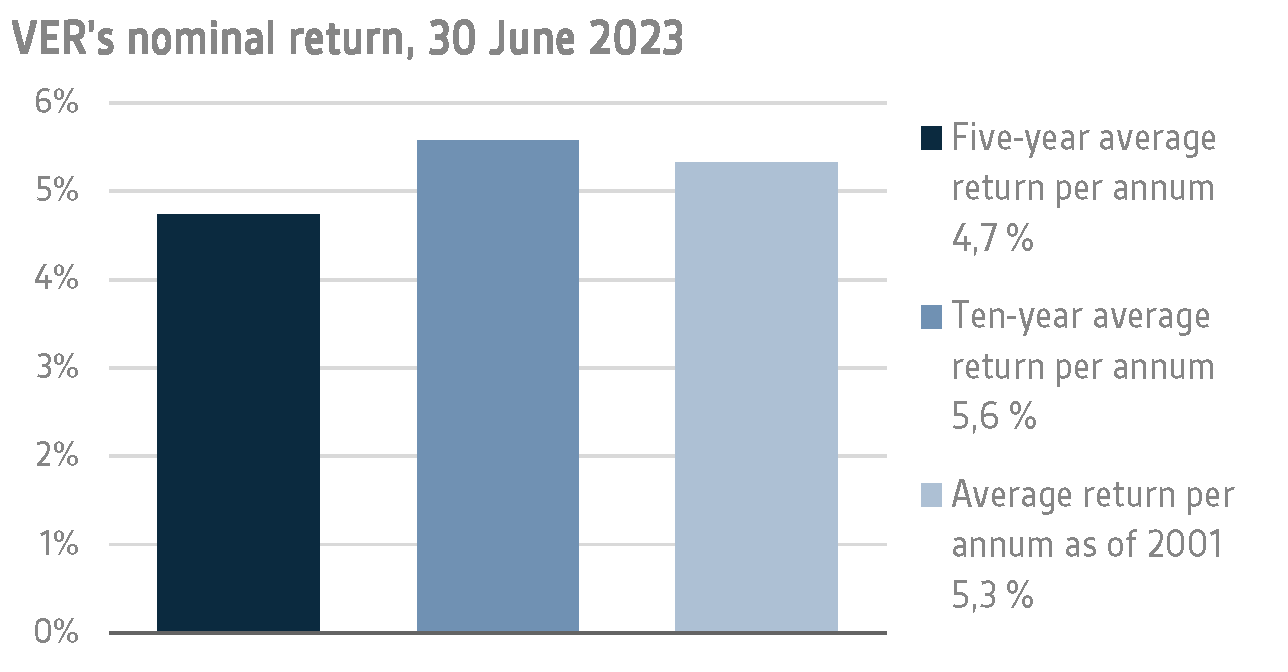

On 30 June 2023, VER’s investment assets totalled EUR 22.1 billion. During the first half of the year, the return on investments at fair values was 3.7 per cent. The average nominal rate of return over the past five years (1 July 2018–30 June 2023) was 4.7 per cent and the annual ten-year return 5.6 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.3 per cent.

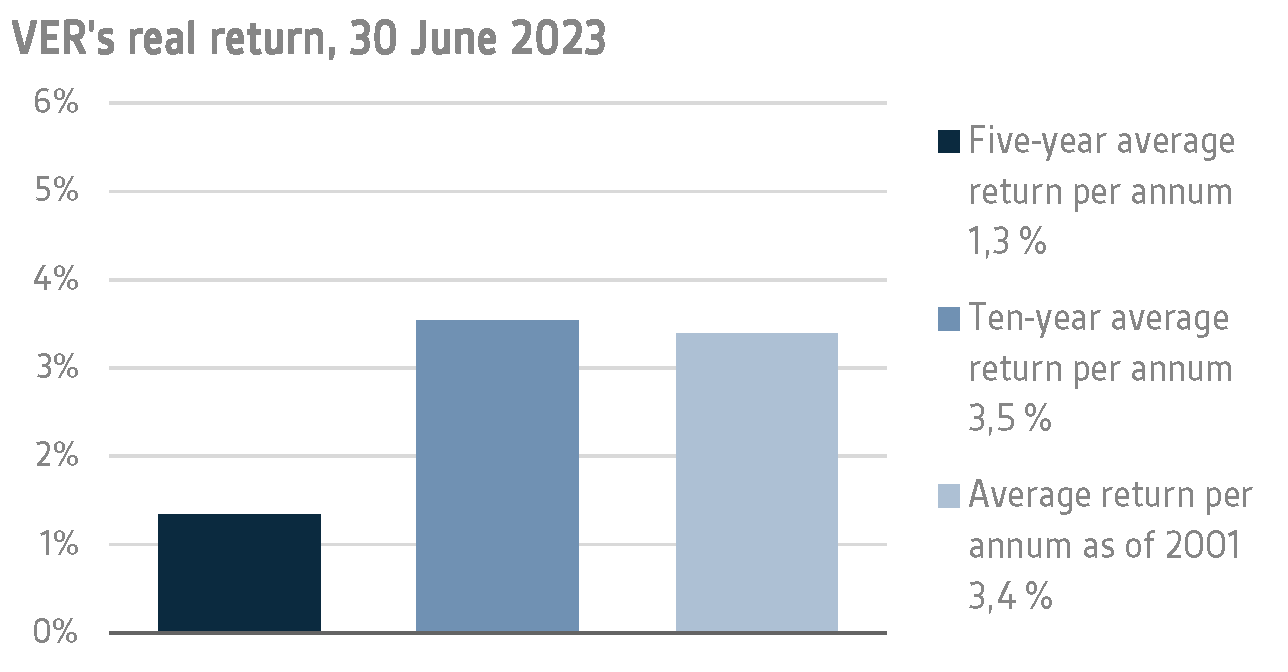

The real rate of return during the first half of 2023 was 0.8 per cent. VER’s five-year average real return was 1.3 per cent and ten-year real return 3.5 per cent. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 3.4 per cent.

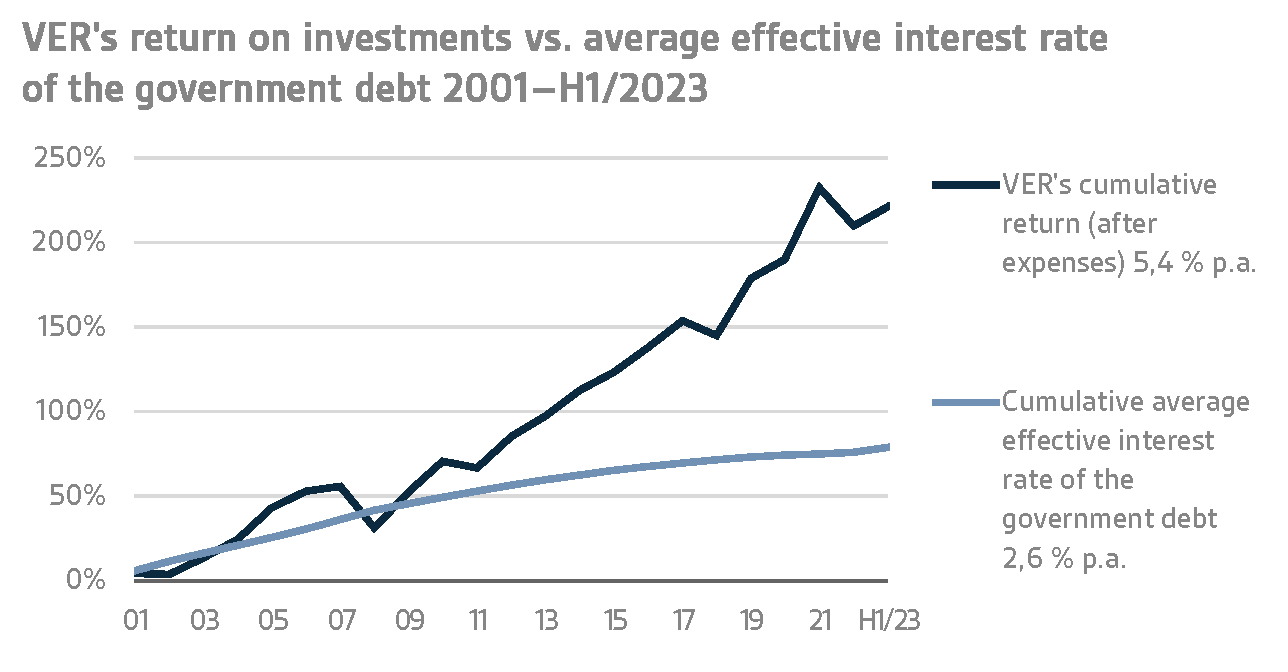

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 4.4 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 9.8 billion over the same period.

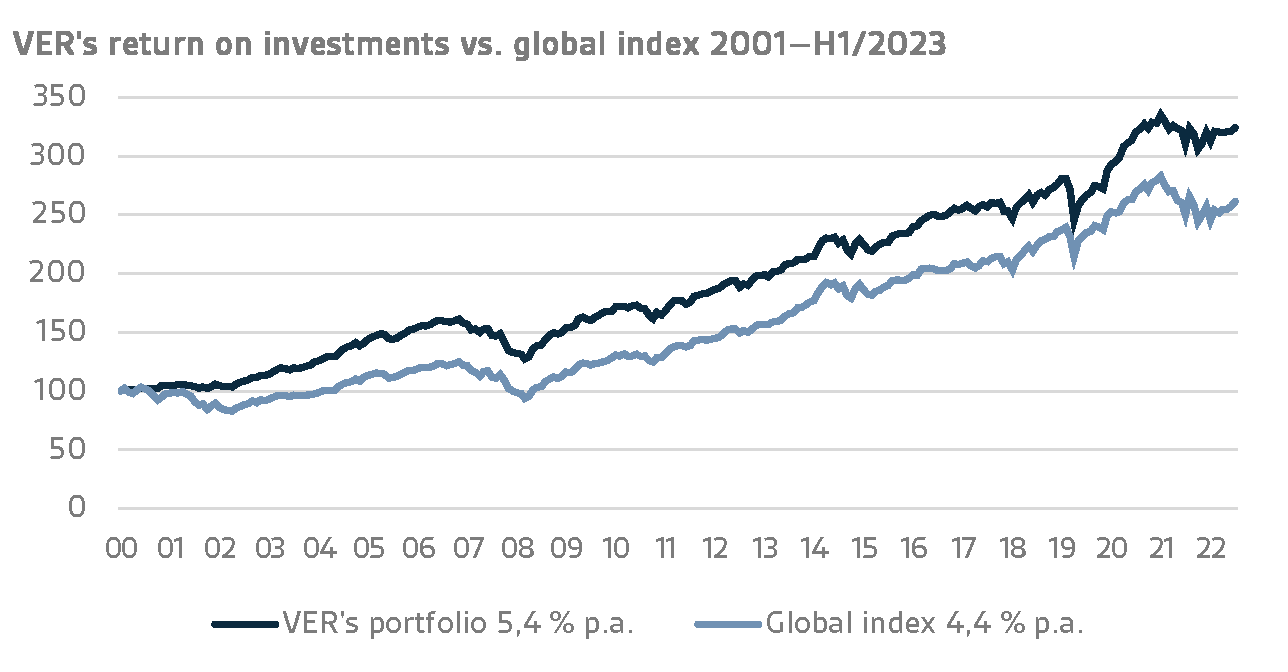

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged fixed income instruments is 50 per cent.

A CLOSER LOOK AT JANUARY–JUNE 2023

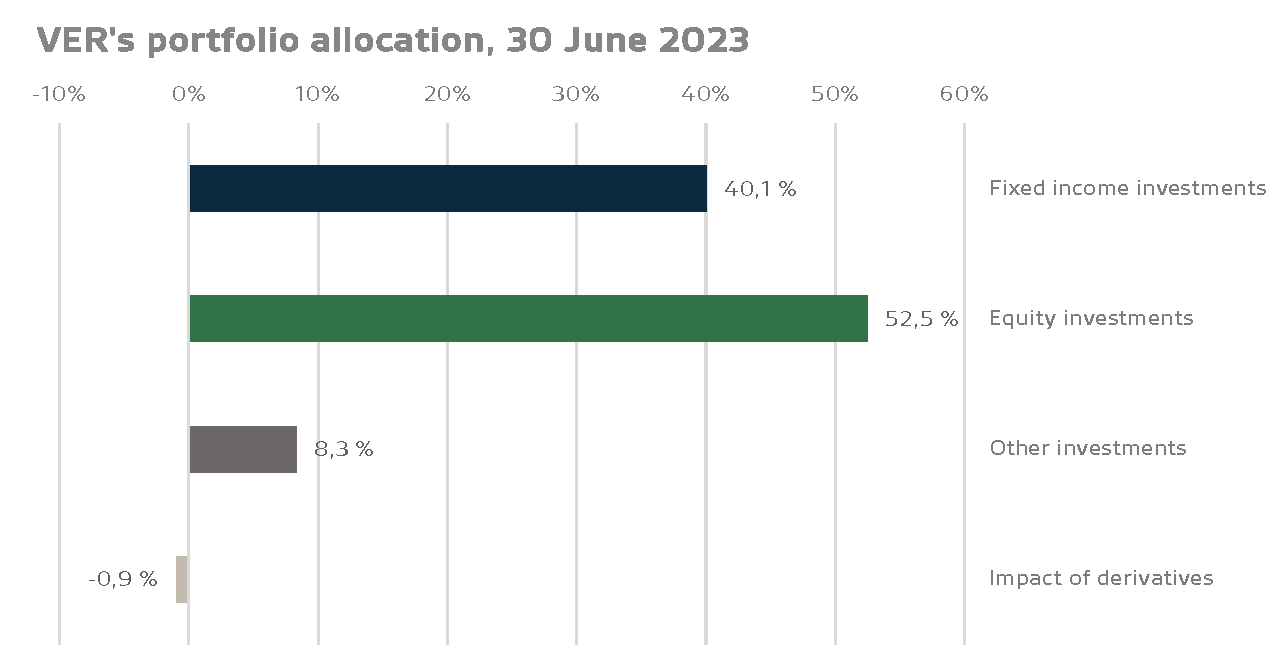

In accordance with the guidelines of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of June, fixed income investments accounted for 40.1 per cent, equities 52.5 per cent and other investments 8.3 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of 2.7 per cent and listed equities 6.2 per cent during the first half of the year.

FIXED INCOME INVESTMENTS

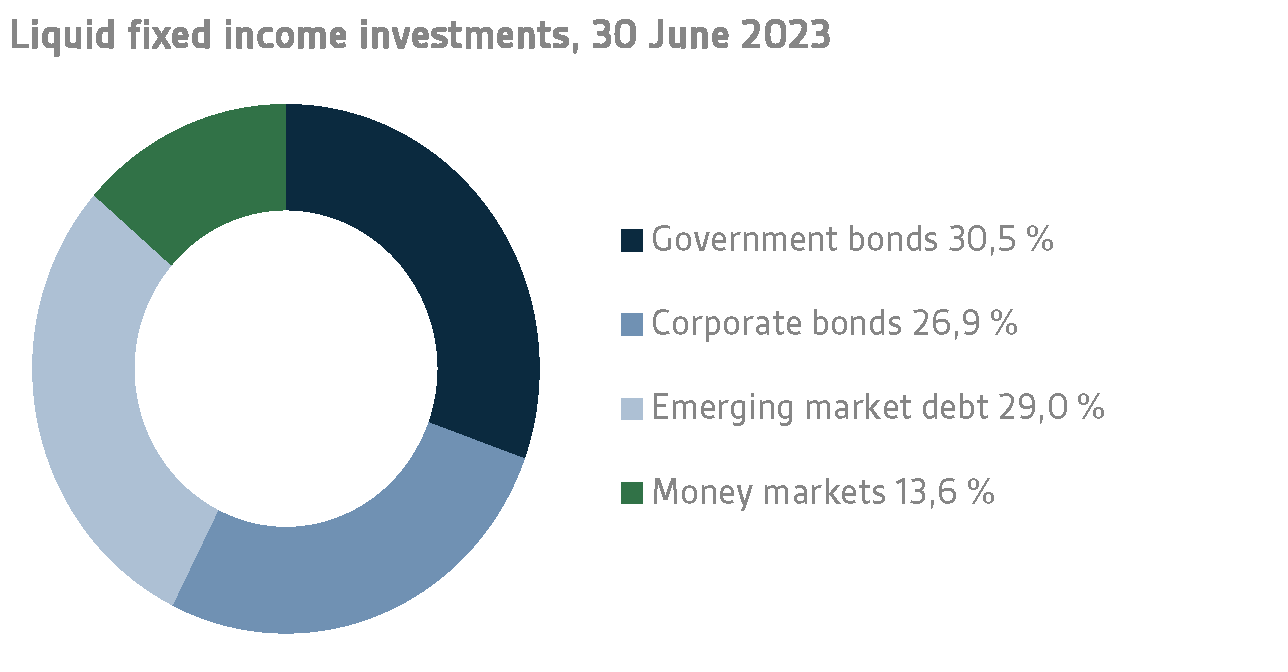

Liquid fixed income investments

During the first half of the year, the return on liquid fixed income instruments was 2.7 per cent.

The banking problems experienced in the first quarter were successfully brought under control in the second quarter, allowing central banks to continue their fight against inflation. Central banks were particularly concerned about the slow decline in core inflation.

During the first six months of the year, both the US Federal Reserve (FED) and the European Central Bank (ECB) continued to tighten monetary policy by raising their policy rates in February, March and May, followed by an additional hike by ECB in June. The FED raised bank rates by 25 basis points at its meetings to range from 5.00% to 5.25%, and the June update of the FED's interest rate projections still forecast two more hikes for 2023. For its part, the ECB raised its policy rates by 150 points, bringing the deposit rate to 3.5%. The ECB indicated that a July rate hike was highly likely, and markets were pricing in another 25-basis point rate hike for the rest of the year.

The risk premiums on corporate bonds continued to narrow in the second quarter after having spread in early March following the problems with the banks.

Of VER's liquid fixed income investments, the best returns were generated by higher-risk instruments, such as the investments in emerging market debt denominated in local currencies and lower-rated corporate bonds, both of which delivered excellent results.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

The return on other fixed income investments was 1.9 per cent. Private credit funds returned 1.7 per cent and direct lending 2.8 per cent.

As most of the private credit loans are floating rate loans, rising interest rates have had a positive impact on the fund operations. A few managers have even raised their return expectations relative to the original projections. At the same time, however, the higher financing costs of the portfolio companies and the general global economic instability have increased the risk of more defaults.

EQUITIES

Listed equities

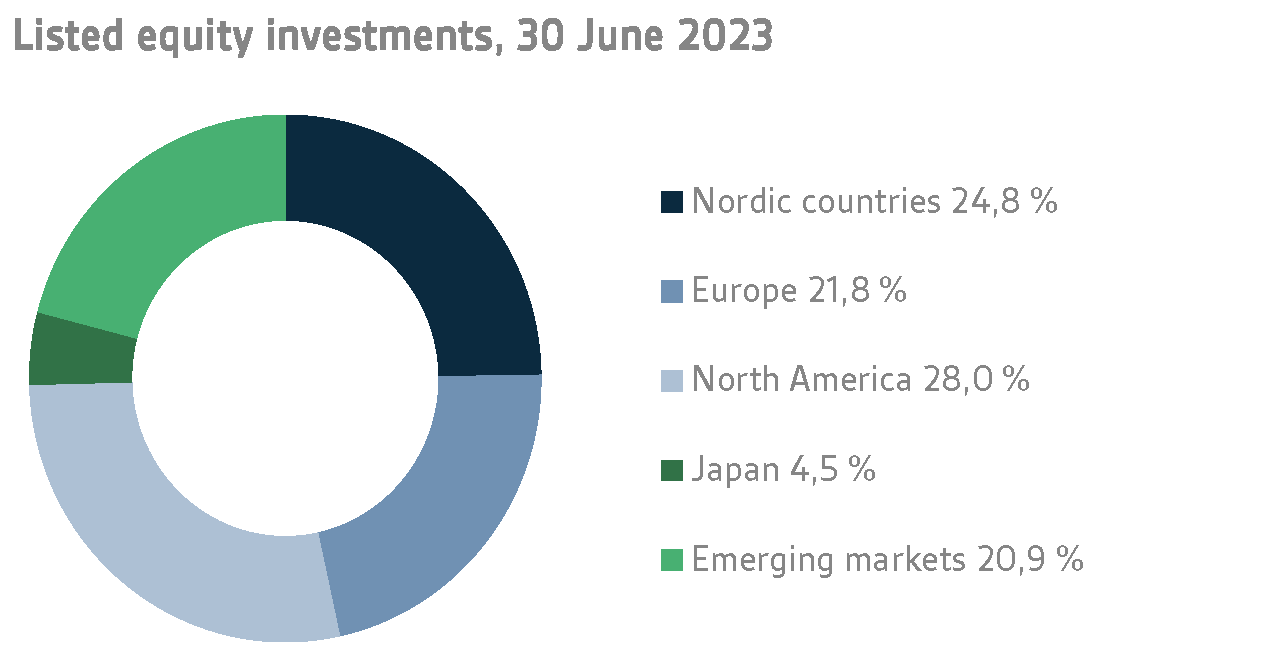

During the first half of the year, the return on listed equities was 6.2 per cent.

The first half of 2023 saw another period of major volatility in global stock markets. While the year got off to a buoyant start, the regional banking crisis in the United States completely upset market sentiment in mid-March. This was clearly evident in bank stocks around the world, but many other sectors were also under pressure as general uncertainty increased substantially in the wake of the crisis. As in many previous emergencies, the authorities did not allow the resulting crisis to spread out of control, and both the United States and Europe undertook strong efforts to avert a catastrophe. However, market pressure continued to be felt for a couple of months, but by the time the half-year drew to a close, the crisis had already eased considerably, at least temporarily.

Another big theme during the first part of the year was inflation, and its greater-than-expected persistence. Over the same period, interest rates fluctuated significantly in response to the various inflation figures, which also led to stock market volatility. Central bank meetings have been watched around the world more closely than for years, and various interpretations of future interest rate measures have been abounding. At times, macro statistics and interest rate decisions have led to major price fluctuations in the stock markets too. In the United States, however, inflation has been steadily falling in the course of the year, inspiring hopes of an end to monetary tightening. As a part of this, technology stocks in particular, partly in the wake of the emerging artificial intelligence "boom", have performed very well in early 2023. This was more than evident in the US equity market, the best performing component of VER's listed equity portfolio during the first six months of the year. Driven by technology stocks, valuation levels have also risen sharply, especially in the United States. The following months will show how strong the basis for the boom in technology stock really is.

Other equity investments

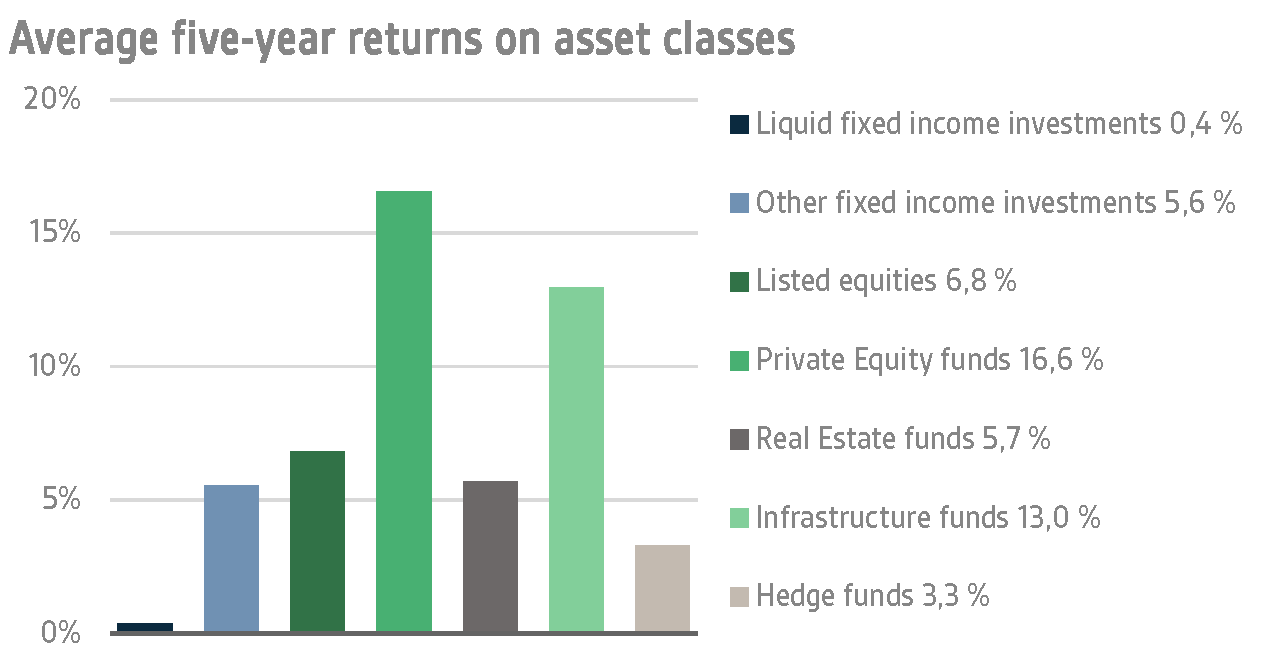

VER’s other equity investments include investments in private equity funds, infrastructure and unlisted equities.

Private equity investments returned 2.2 per cent, infrastructure funds 3.1 per cent and unlisted equities 4.7 per cent.

Although investors' concerns about the falling valuation levels of private equity investments were evident at the beginning of the year, the positive performance of equity markets has continued to uphold the value of portfolio companies. Moreover, the portfolio companies have been doing surprisingly well throughout the first half of the year given the current operating environment. Although the transaction market has clearly slowed down, some highly successful exits were accomplished by fund managers in the spring.

Infrastructure investments have continued to perform fairly well. As an inflation hedge, they have helped offset the valuation pressure due to rising interest rates.

OTHER INVESTMENTS

VER’s other investments consists of investments in real estate investment trusts, hedge funds and risk premium strategies.

The return on investments in non-listed real estate funds was -1.1 per cent.

The real estate transaction market remains dormant. The increase in yield requirements due to rising interest rates has depressed property values in almost all sectors, also negatively affecting VER's real estate fund returns. New construction is declining, particularly housing production.

Hedge funds and systematic strategies returned -0.6% in the first half of the year.

Of the hedge funds, the best performance was put in by quantitative strategies. With funds focusing on multi-strategies, there was a lot of dispersion in returns, with total yields close to zero. The period proved particularly challenging for macro funds, which tended to adopt a premature position with regard to changes in the monetary policy pursued by central banks. The return on systematic strategies was slightly negative during the first few months of the year, but sound returns were achieved on other derivative positions, especially in foreign exchange and credit derivatives.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The role of the State Pension Fund in equalising the government’s pension expenditure continues to grow. In 2022, the State’s pension expenditure totalled over EUR 5.0 billion while the 2023 budget foresees an expenditure of nearly EUR 5.3 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2023 budget will amount to over EUR 2.1 billion.

By the end of June, VER had transferred EUR 1.1 billion to the government budget. Over the same period, VER’s pension contribution income totalled EUR 0.9 billion. The pension contribution income matched the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

VER reached its 25% funding ratio target on 31 December 2021, much earlier than expected. Following the attainment of the funding ratio, the Act on the State Pension Fund was amended and entered into force in April 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. Consequently, VER’s budget transfers will be gradually increased from the current 40 per cent to 45 per cent during 2024–2028. If the funding ratio exceeds 25 per cent for two consecutive calendar years, an additional transfer of three percentage points will be made to the government budget. Given VER’s growing role in offsetting government pension expenditure and the increase in negative net transfers, VER’s funding ratio is expected to fall in the coming years.

Following the legal reform, VER’s Board of Directors initiated a strategy development process. The strategy was updated concurrently with the 2023 investment plan and adopted in January 2023. The objectives set out in the strategy create the basis for future investment activities. The baseline allocation of the investment portfolio is determined in the annual investment plan. Simulations suggest that the baseline allocation of the portfolio will achieve the long-term objectives established for VER.

|

KEY FIGURES

|

|

|

|

|

30.6.2023

|

31.12.2022

|

30.6.2022

|

|

Investments, MEUR (market value)

|

22 128

|

21 604

|

21 566

|

|

Fixed income investments

|

8 863

|

8 791

|

8 680

|

|

Equity investments

|

11 626

|

10 285

|

10 254

|

|

Other investments

|

1 847

|

2 777

|

2 640

|

|

Impact of derivatives

|

-209

|

-249

|

-8

|

|

|

|

|

|

Breakdown of the investment portfolio

|

|

|

|

|

Fixed income investments

|

40,1 %

|

40,7 %

|

40,2 %

|

|

Equity investments

|

52,5 %

|

47,6 %

|

47,5 %

|

|

Other investments

|

8,3 %

|

12,9 %

|

12,2 %

|

|

Impact of derivatives

|

-0,9 %

|

-1,2 %

|

0,0 %

|

|

|

|

|

|

1.1.–30.6.2023

|

1.1.–31.12.2022

|

1.1.–30.6.2022

|

|

Return on investment

|

3,7 %

|

-6,8 %

|

-7,3 %

|

|

Fixed income investments

|

|

|

|

|

Liquid fixed income investments

|

2,7 %

|

-8,2 %

|

-7,4 %

|

|

Other fixed income investments

|

1,9 %

|

0,4 %

|

1,6 %

|

|

Private Credit funds

|

1,7 %

|

-0,5 %

|

1,4 %

|

|

Equity investments

|

|

|

|

|

Listed equity investments

|

6,2 %

|

-12,4 %

|

-13,5 %

|

|

Private Equity investments

|

2,2 %

|

12,5 %

|

10,6 %

|

|

Unlisted equity investments

|

4,7 %

|

7,8 %

|

7,6 %

|

|

Other investments

|

|

|

|

|

Unlisted Real Estate funds

|

-1,1 %

|

4,1 %

|

3,9 %

|

|

Infrastructure funds

|

3,1 %

|

15,6 %

|

10,0 %

|

|

Hedge funds

|

-0,6 %

|

5,0 %

|

3,7 %

|

|

|

|

|

|

Pension contribution income, MEUR

|

862

|

1 610

|

819

|

|

Transfer to state budget, MEUR

|

1 063

|

1 982

|

999

|

|

Net contribution income, MEUR

|

-201

|

-372

|

-180

|

|

Pension liability, BnEUR

|

|

97

|

|

|

Funding ratio, %

|

|

22 %

|

|

Additional information: CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 (0)295 201 210

Established in 1990, the State Pension Fund of Finland (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of June 2023, the market value of the Fund’s investment portfolio stood at EUR 22.1 billion.

All figures presented in this interim report are preliminary and unaudited.