INVESTMENT ENVIRONMENT

A number of risks materialised simultaneously during the first half of 2022. While the first few months of the year were characterised by the disruptive effects of Covid-19 on society and the economy, world news has since February been riddled with a range of geopolitical tensions. Russia’s war of aggression was launched on 24 February 2022. After that date, a lot of things changed in Europe, and globally.

The economic situation and outlook turned gloomy during the first part of the year. Inflation soared to new heights in the United States, Europe and the rest of the world. The accelerating inflation was driven by higher energy prices, especially natural gas and oil. At the same time, economic growth in the United States was so vigorous as to generate a shortage of labour, which tended to push up wages. Moreover, the availability of goods was still hampered by the Covid-induced bottlenecks while China adopted stringent restrictions in early 2022. All these developments, coupled with the opening-up of the economy, led to a strong surge in inflation. However, a slight easing of inflationary pressures is discernible after the reporting period.

As far as the central banks are concerned, there was a clear trend towards tighter monetary policies. Key interest rates were raised in the United States and Europe. Although the interest rate hikes do not have a direct impact on all the sub-components of inflation, the tightening monetary policy weakened the cyclical outlook and thus helped to contain inflation expectations. During the second quarter, stagflation – high inflation accompanied by recession – emerged as potentially the most serious risk. While stagflation was talked about during the reporting period, no actual recession has yet set in.

The prevailing economic and geopolitical environment had a negative impact on VER's investment activities. Liquid assets in equity and fixed income markets depreciated in value, but illiquid over-the-counter assets have not yet seen a general decline in value. The market situation improved towards the end of the reporting period.

VER’S RETURN ON INVESTMENTS

Future monitoring and evaluation of VER’s investment activities will focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments.

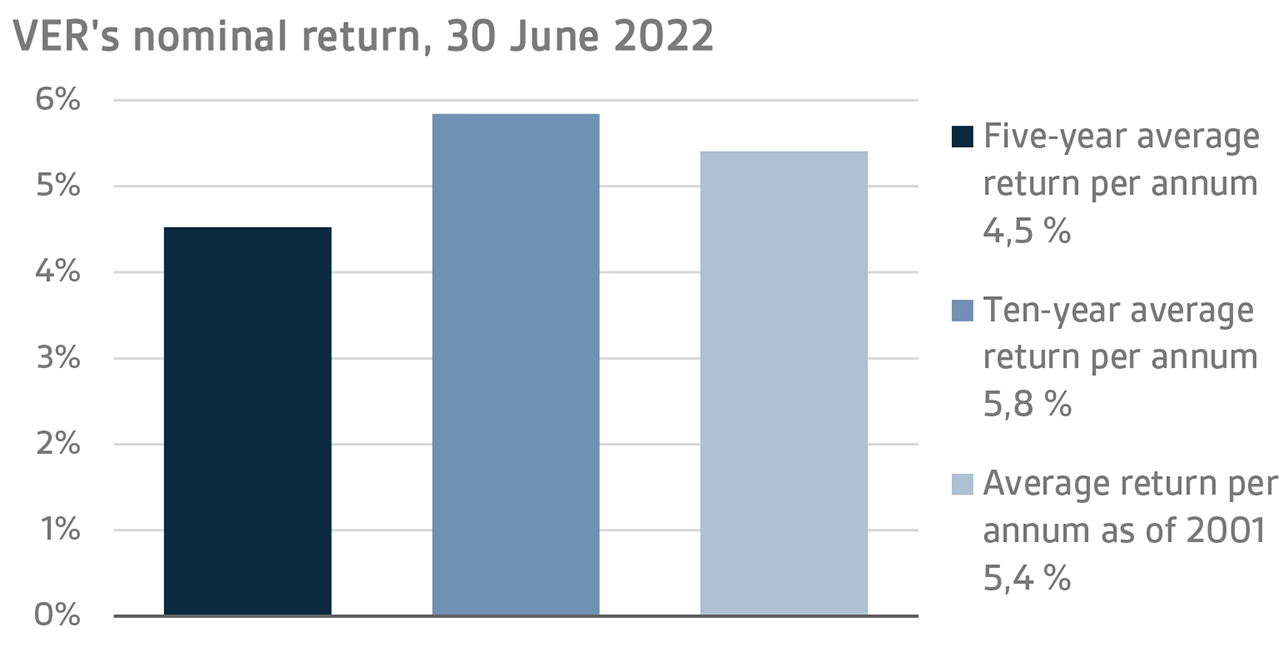

On 30 June 2022, VER’s investment assets totalled EUR 21.6 billion. During the first half of the year, the return on investments at fair values was -7.3 per cent. The average nominal rate of return over the past five years (1 July 2017–30 June 2022) was 4.5 per cent and the annual ten-year return 5.8 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.4 per cent.

The real rate of return during the first half of 2021 was -12.3 per cent. VER’s five-year average real return was 2.1 per cent and ten-year real return 4.3 per cent. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 3.7 per cent.

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 4.6 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 9 billion over the same period.

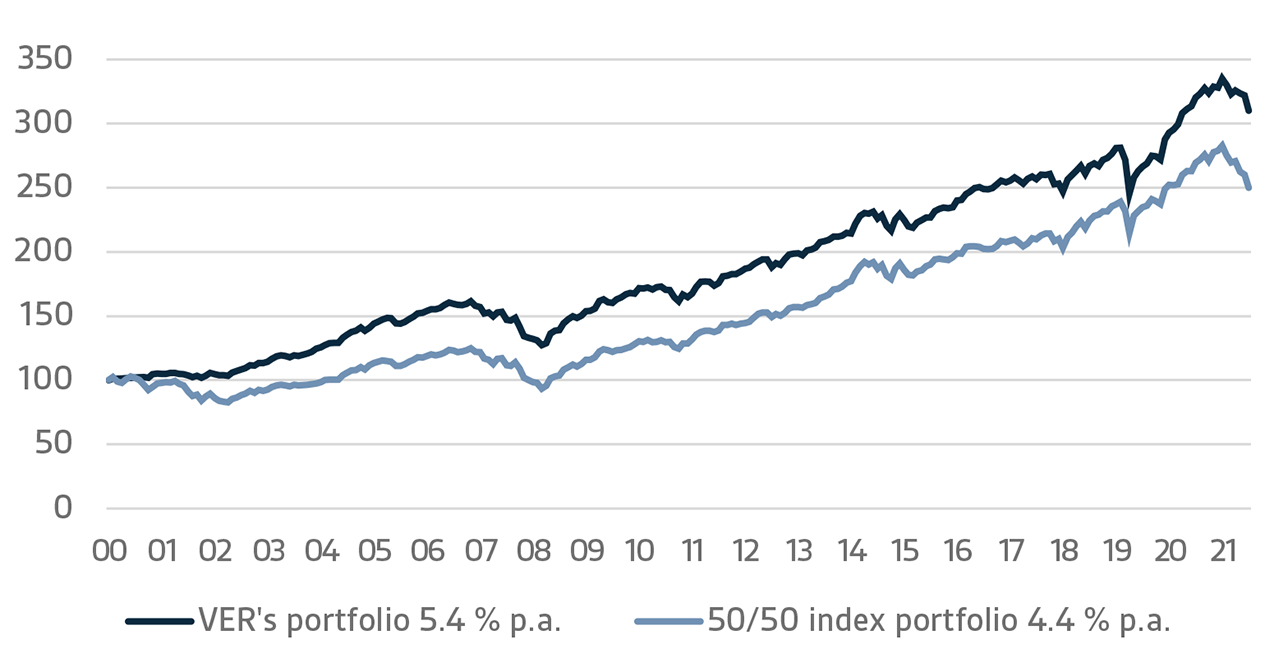

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged bonds is 50 per cent.

A CLOSER LOOK AT JANUARY–JUNE 2022

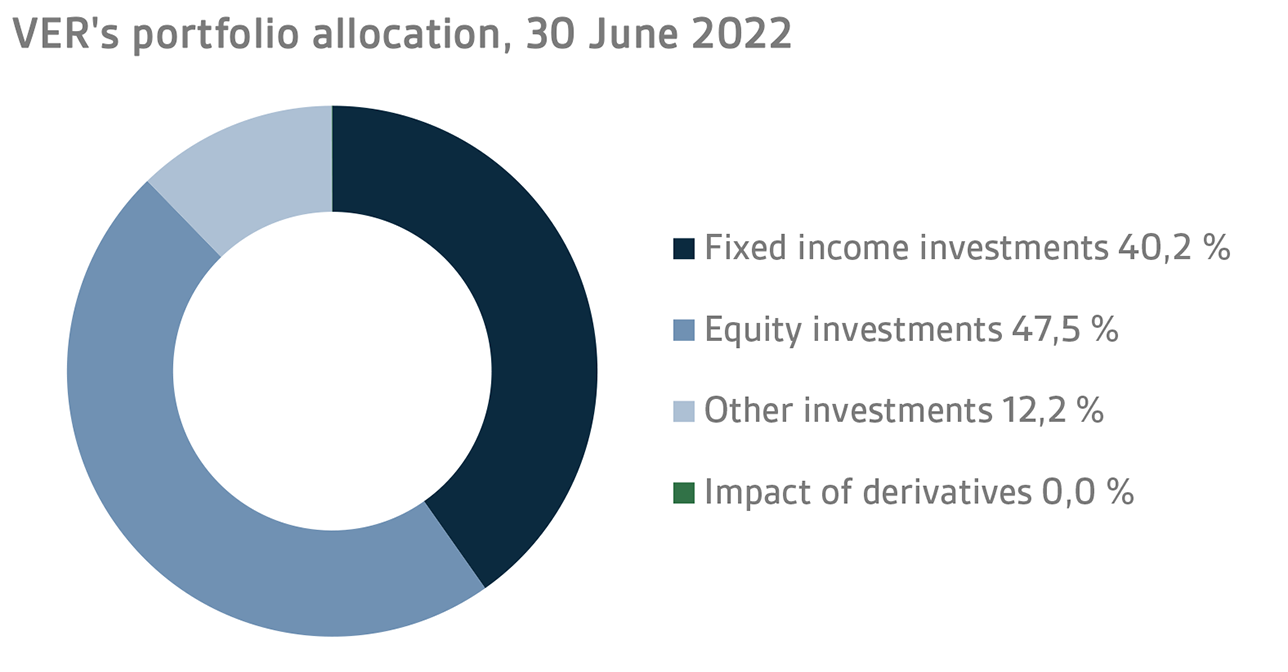

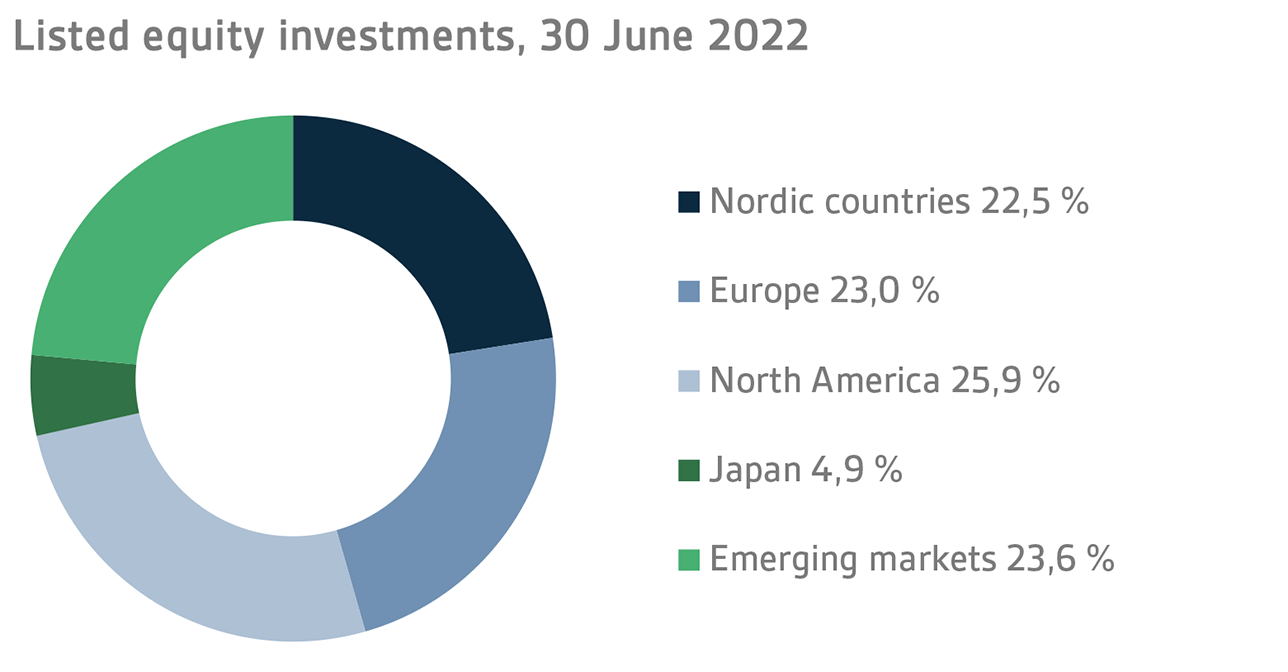

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of June, fixed income instruments accounted for 40.2 per cent, equities 47.5 per cent and other investments 12.2 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of -7.4 per cent and listed equities -13.5 per cent during the first half of the year.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

During the first half of the year, the return on liquid fixed income instruments was -7.4 per cent.

In January-June, inflation, the rise in interest rates and the tighter monetary policies of central banks accelerated substantially since the turn of the year. Towards the end of February, the crisis in Ukraine caused a temporary drop in interest rates, especially for the supposedly safe government bonds, but otherwise the extremely high inflation rates and tightening monetary policy pushed up interest rates sharply and increased the spreads in risk premiums on corporate bond investments, particularly in the second quarter.

The Federal Reserve continued to raise interest rates in the second quarter at a faster pace than in the first quarter, raising its refinancing rate by 50 basis points in May and 75 basis points in June. At its June meeting, the FED implied that the bank rate would reach 3.4 per cent (previously 1.9%) by the end of the year. Moreover, the FED is off-loading its balance sheet at an increasing pace. The market expected an even faster rate of increase: 3.6 per cent by the end of the year and no less than 3.9 per cent by June next year. During the second quarter, the expectations jumped by about 100 basis points.

The European Central Bank (ECB) announced at its June meeting that it would end net purchases of the Asset Purchase Programme (APP) in early July and indicated that it would raise its key rates by 25 points at its July meeting. As a result of the announcement, the spread between Italian and German government bonds widened, causing the ECB to hold an emergency meeting and announce the establishment of a new crisis tool designed to address the unwanted interest rate differentials. The German ten-year rate rose by around 80 basis points to 1.33 per cent in the second quarter, while the Italian ten-year rate rose by over 120 basis points to 3.25 per cent, having peaked at well over 4 per cent.

The spread in risk premiums on corporate loans grew in the second quarter as the economic outlook weakened following a sharp rise in interest rates. For example, the iTraxx Crossover cds index rose by almost 250 basis points to 582 points in the second quarter after starting the year below 250

As far as VER’s liquid fixed income investments are concerned, the increase in interest rates eroded returns on emerging market dollar-denominated bonds in particular. Moreover, the absolute returns generated by other fixed income assets classes were not that great, either, due to the increase in interest rates and growing spreads in risk premiums.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

The return on other fixed income investments was 1.6 per cent. Private credit funds returned 1.4 per cent and direct lending 2.5 per cent.

Although market sentiment turned negative during the spring as a result of the war in Ukraine, it has so far had little impact on the portfolios of private credit funds, with June returns still reflecting those of the first quarter. However, the problems with supply chains experienced even before the war continued to have some effect on the portfolio companies. As most of the private credit loans are floating rate loans, rising interest rates have a positive impact on the fund operations. At the same time, the increase in companies’ financing costs pose a risk of non-performing loans.

EQUITIES

Listed equities

During the first half of the year, the return on listed equities was -13.5 per cent.

At the beginning of 2022, the mood in the stock market was sour. Stock prices started falling right at the outset, mainly due to the fear of rising interest rates and the impact that this would have. A number of other themes that had not affected the sentiment in the bull market of 2021 also resurfaced, such as the rising energy prices and problems with supply chains. By far the strongest impact on poor market performance during the first six months of the year was, however, delivered by Russia’s war of aggression on Ukraine. As a result of the developments in Ukraine, the market sentiment turned gloomy, and by the end of the first half of the year, all sub-portfolios of listed equities were clearly in the red.

Moreover, early 2022 brought with it many things we had not seen for a long a time. Inflation figures were extremely high across the board, while central banks recalibrated their forecasts predicting a more long-term inflation instead of a temporary peak as previously. With the increasing inflation, interest rates started to seesaw. This had major implications for the stock market, and the first few months of the year saw a sharp fall in the stock prices of high-value growth companies, particularly in the United States. Small companies too suffered from the change in market sentiment. Russia’s attack on Ukraine only served to undermine the mood further. Energy prices shot up and other effects of the war were also substantial. A large number of listed companies with a presence in Russia announced their withdrawal from the country, which in some cases led to massive write-downs in their balance sheets. Many Nordic companies were particularly hard hit by the situation in Russia, which was adversely reflected in the share prices.

As if this was not enough, Covid-19 gained new momentum in China in early 2022, which led the Chinese Government to adopt, once again, strict measures to combat the pandemic. This had a major impact on the supply chains of several listed companies, just when the situation seemed to be improving slightly after the problems experienced in recent years. Hence, there was no lack of uncertainties in the first half of the year, which was reflected in the weak performance of stock markets. Given that this was preceded by extremely high and sustained returns on equities, periods of weaker performance are probably inevitable. Only time will tell what the mood will be like at the end of the year.

Other equity investments

VER’s other equity investments include investments in private equity funds and unlisted equities.

Private equity investments returned 10.6 per cent and unlisted equities 7.6 per cent.

With private equity investments, the impact of the war in Ukraine on returns was still negligible at the end of June, as the returns were based on first-quarter valuations and, to some extent, on the returns earned in the last quarter of 2021. However, the actual second-quarter returns that funds will release in early autumn will be somewhat affected by the market turbulence and rising production costs in the spring. For now, it appears that the increased production costs have been successfully passed on to the prices paid by end customers.

Underlying the returns generated by unlisted equities are increased valuations.

OTHER INVESTMENTS

VER’s other investments are investments in real estate, infrastructure, hedge funds and risk premium strategies.

The return on unlisted real estate funds was 3.9 per cent while infrastructure investments yielded 10.0 per cent.

Higher financing costs and rising inflation have so far not been reflected in the returns on real estate funds. The logistics sector, in particular, has put in an impressive performance during the first few months of 2022. However, the market is already seeing a rise in the price of money, which may make it more difficult to refinance properties. Even so, expectations for the rest of the year have remained unshaken, although a small increase in required returns may be expected.

As in the case of real estate funds, the end-June returns for infrastructure funds are based on the first quarter of the current year and, to some extent, the last quarter of 2021. Consequently, the effects of the war in Ukraine and market turbulence are not reflected in the returns on the portfolio. Moreover, as a significant part of VER's infrastructure fund portfolio consists of so-called core infrastructure assets, market volatility, financial appreciation and high inflation are not much felt in the portfolio. Earnings for the rest of the year are therefore not expected to be significantly affected by the current market situation.

Hedge funds and systematic strategies returned 3.7 per cent in the first half of the year. Macro funds and quantitative strategies, in particular, performed well in the challenging risk market environment. Returns were generated by successful positioning in fixed income markets and commodities. More modest returns were earned on funds focusing on Asia, mainly due to the problems in the Chinese property sector. For systematic strategies, the first six months of the year were challenging.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The role of the State Pension Fund in equalising the government’s pension expenditure continues to grow. In 2021, the State’s pension expenditure totalled over EUR 4.8 billion while the 2022 budget foresees an expenditure of nearly EUR 4.9 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2022 budget will amount to about EUR 1.9 billion.

By the end of June, VER had transferred EUR 999 million to the government budget. Over the same period, VER’s pension contribution income totalled EUR 819 million. The pension contribution income matched the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

The new law on the State Pension Fund of Finland took effect on 8 April 2022. A key amendment is an increase in government budget transfers from 40 to 45 per cent, to be phased in during 2024–2028. In addition, if VER's funding rate rises above 25 per cent for two consecutive calendar years, an additional 3 per cent transfer will be made until the funding rate falls below 25 per cent. As the State’s pension liabilities amounted to EUR 93.3 billion at the end of 2021, the funding ratio was approx. 25.4 per cent. VER will assess the exact impact of the amendment on VER's strategy and investment planning during 2022.

KEY FIGURES

|

|

|

|

|

30.6.2022

|

31.12.2021

|

30.6.2021

|

|

Investments, MEUR (market value)

|

21 566

|

23 595

|

22 666

|

|

Fixed income investments

|

8 680

|

8 951

|

8 071

|

|

Equity investments

|

10 254

|

11 687

|

11 997

|

|

Other investments

|

2 640

|

2 691

|

2 338

|

|

Impact of derivatives

|

-8

|

266

|

258

|

|

|

|

|

|

Breakdown of the investment portfolio

|

|

|

|

|

Fixed income investments

|

40,2 %

|

37,9 %

|

35,6 %

|

|

Equity investments

|

47,5 %

|

49,5 %

|

52,9 %

|

|

Other investments

|

12,2 %

|

11,4 %

|

10,3 %

|

|

Impact of derivatives

|

0,0 %

|

1,1 %

|

1,1 %

|

|

|

|

|

|

1.1.–30.6.2022

|

1.1.–31.12.2021

|

1.1.–30.6.2021

|

|

Return on investment

|

-7,3 %

|

14,6 %

|

9,3 %

|

|

Fixed income investments

|

|

|

|

|

Liquid fixed income investments

|

-7,4 %

|

0,7 %

|

0,6 %

|

|

Other fixed income investments

|

1,6 %

|

11,6 %

|

4,5 %

|

|

Private Credit funds

|

1,4 %

|

13,1 %

|

4,9 %

|

|

Equity investments

|

|

|

|

|

Listed equity investments

|

-13,5 %

|

24,2 %

|

15,9 %

|

|

Private Equity investments

|

10,6 %

|

47,7 %

|

20,4 %

|

|

Unlisted equity investments

|

7,6 %

|

57,9 %

|

45,6 %

|

|

Other investments

|

|

|

|

|

Unlisted Real Estate funds

|

3,9 %

|

13,3 %

|

4,0 %

|

|

Infrastructure funds

|

10,0 %

|

14,9 %

|

7,9 %

|

|

Hedge funds

|

3,7 %

|

5,1 %

|

3,5 %

|

|

|

|

|

|

Pension contribution income, MEUR

|

819

|

1 550

|

791

|

|

Transfer to state budget, MEUR

|

999

|

1 941

|

-973

|

|

Net contribution income, MEUR

|

-180

|

-391

|

-182

|

|

Pension liability, BnEUR

|

|

93,3

|

|

|

Funding ratio, %

|

|

25 %

|

|

Additional information: Additional information is provided by CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 (0)295 201 210

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of June 2022, the market value of the Fund’s investment portfolio stood at EUR 21.6 billion.

All figures presented in this interim report are preliminary and unaudited.