VER’s return on investment 5.2% during 1 Jan–31 March 2019; ten-year average annual return 6.0%

Published 2021-05-06 at 15:29

INVESTMENT ENVIRONMENT

The economy continued to recover during the first quarter of 2021. Despite the spread of the coronavirus and at times extensive restrictions imposed by governments, the stock markets thrived. This is partly explained by a widespread belief in the efficiency and roll-out of coronavirus vaccines and the assumption that the virus would lose steam as the summer approaches. As a result of these developments and the low starting point, economic growth is expected to be robust, especially in the latter half of 2021.

Governments and central banks continued to pursue an expansive policy in early 2021. Support measures are widely perceived as necessary. At the same time, the focus in the public debate is shifting towards the amount of debt in the long term. In the United States, this debate and inflation concerns triggered an increase in the interest rates on government bonds. At least for now, the prevailing view is that the increase of the inflation rate to over 2 per cent would be temporary.

Equity markets grew by almost 10 per cent depending on the market area. Of the individual industries, there were uncertainties concerning the technology sector whereas traditional industries, value stocks and small companies did well.

A more active approach to the global climate policy accompanied by strained geopolitical relationships both brought the great powers closer to one another, while at the same time bringing them apart. In early 2021, the situation in Ukraine grew tense. At the same time, news was spreading around the world about recent cyber activity. In the climate policy, the United States and China are adopting new leadership roles while Europe is forging ahead and achieving steady progress. These developments infuse confidence in climate action over the next few years.

VER’S RETURN ON INVESTMENTS

Future monitoring and evaluation of the State Pension Fund’s investment activities will increasingly focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments to the same extent as previously.

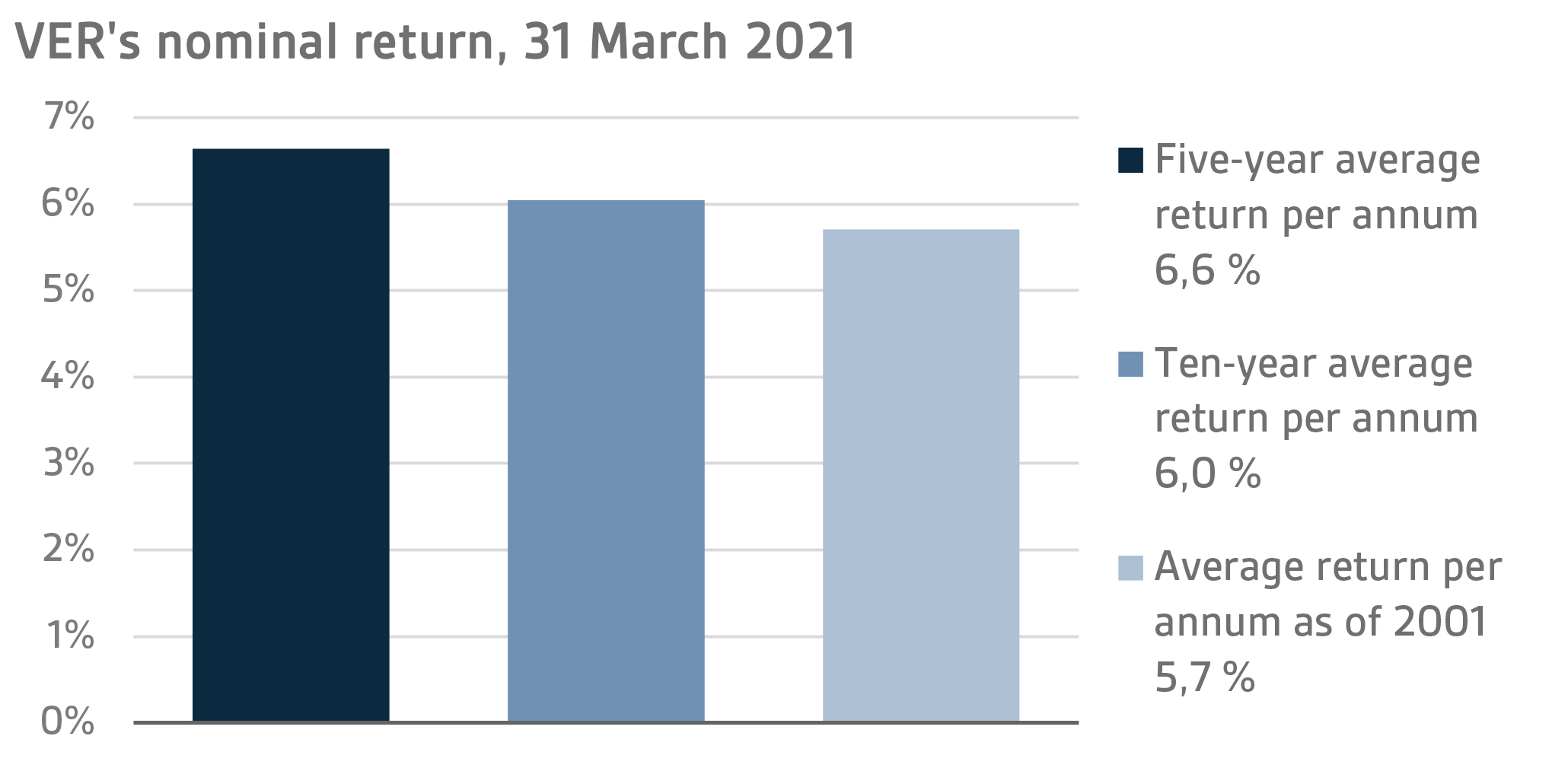

On 30 March 2021, VER’s investment assets totalled EUR 21.9 billion. During the first quarter, the return on investments at fair values was 5.2 per cent. The average nominal rate of return over the past five years (1 April 2016–31 March 2021) was 6.6 per cent and the annual ten-year return 6.0 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.7 per cent.

The real rate of return during the first quarter of 2021 was 4.2 per cent. VER’s five-year average real return was 5.6 per cent and ten-year real return 5.0 per cent. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 4.3 per cent.

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 4.5 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 9.1 billion over the same period.

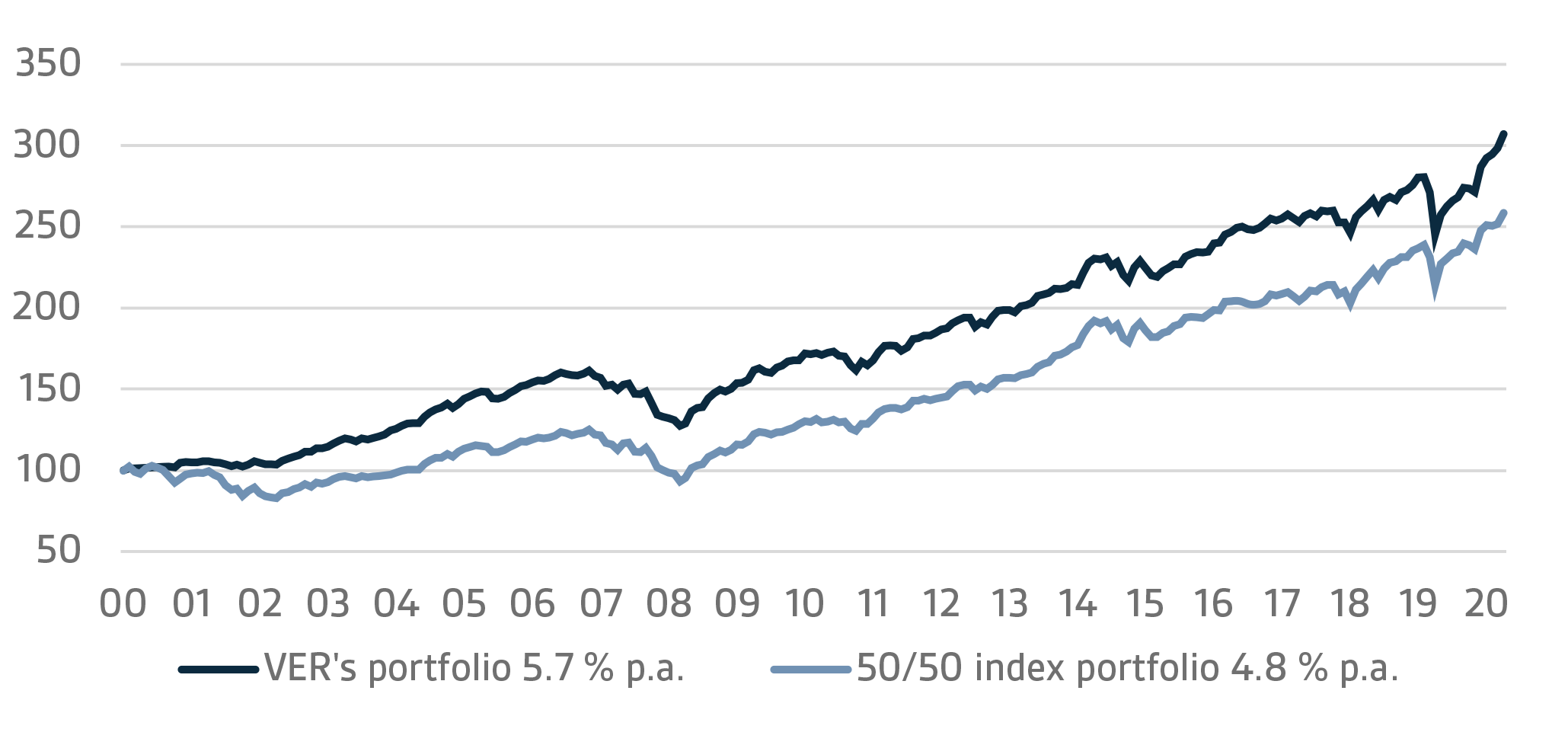

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged bonds is 50 per cent.

A CLOSER LOOK AT JANUARY–MARCH 2021

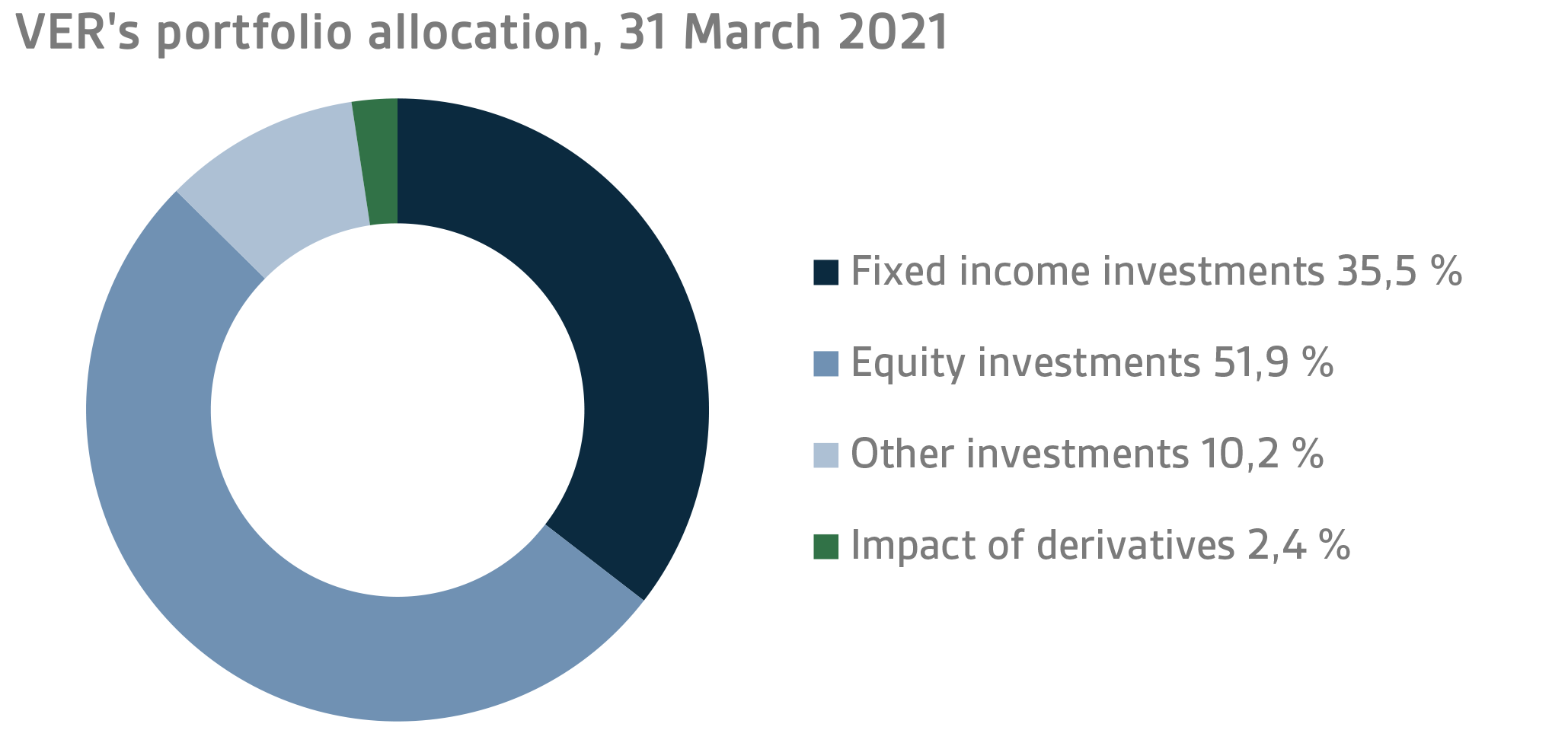

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of March, fixed income instruments accounted for 35.5 per cent, equities 51.9 per cent and other investments 10.2 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of -0.4 per cent and listed equities 9.4 per cent during the first quarter of the year.

FIXED INCOME INVESTMENTS

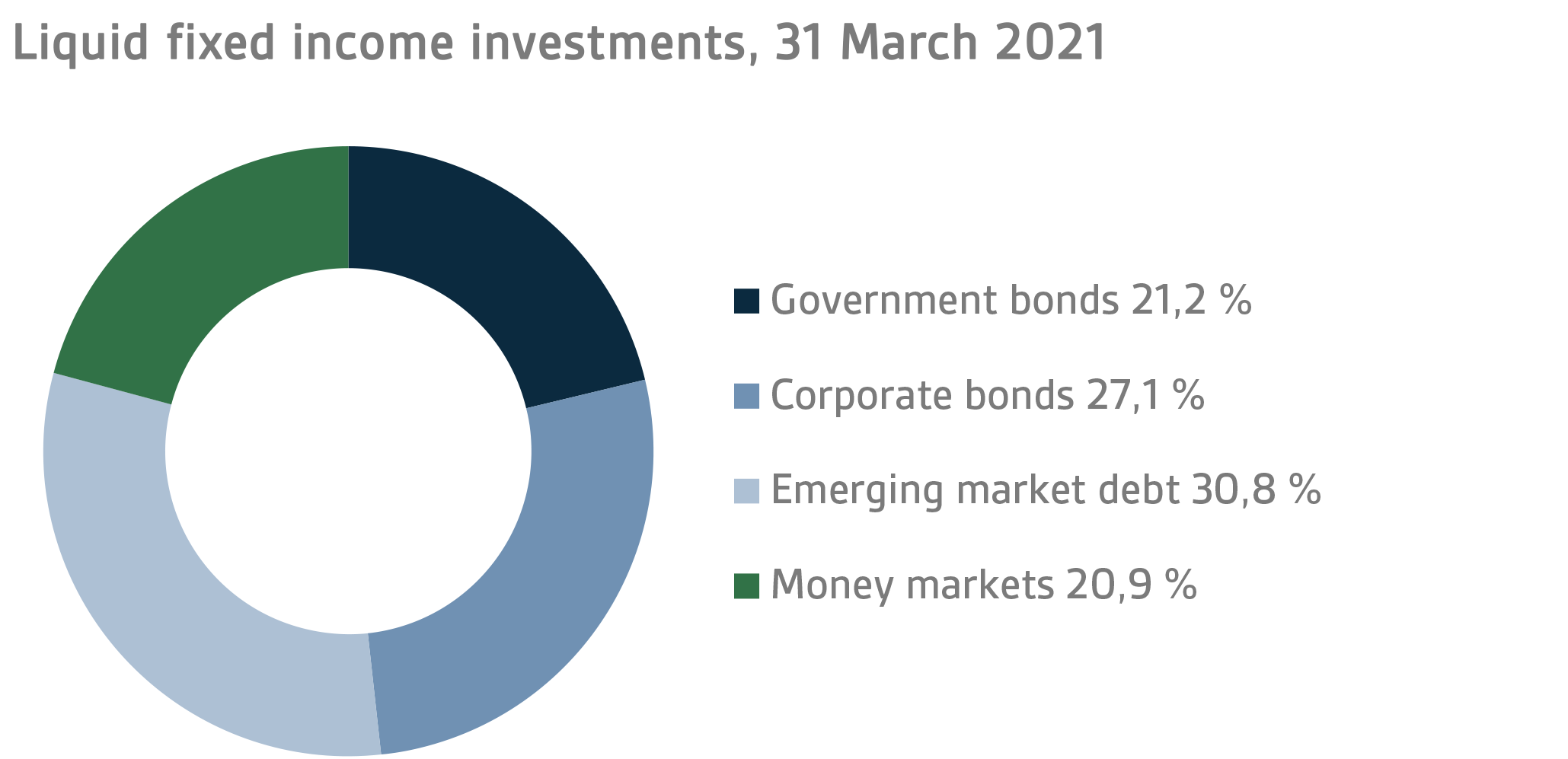

Liquid fixed income investments

During the first quarter, the return on liquid fixed income was -0.4 per cent.

Attention during this period was focused on the progress made in COVID-19 vaccination programmes, infection rates and the fate of the US stimulus package. Central banks indicated that they would continue to pursue an easy monetary policy.

The US Federal Reserve (FED) assured that it would stick to its current zero-interest policy until the employment and inflation rates reach the levels expected by the FED. According to the FED, interest rates will not be raised until after 2023. As the fixed income market became concerned about the combined effect of the easy monetary policy and massive fiscal stimulation, the interest rate curve shot up sharply. The US ten-year bond rate rose from 0.91 percent at the turn of the year to 1.74 per cent at the end of March. The quarterly return on the US government bond index was the lowest since 1980, -4.13 per cent.

In Europe, interest rates rose at a more moderate rate, but despite this the European Central Bank became concerned about the increase in rates and the impact of the COVID-19 situation on the economy and decided, at its March meeting, to accelerate PEPP purchases for three months to prevent financial conditions from tightening. In the first quarter, the interest rate on German 10-year government bonds increased almost 30 basis points to -0.29 per cent.

As far as VER’s liquid fixed income investments are concerned, the increase in interest rates eroded returns on emerging market bonds in particular. By contrast, US government bonds gave a healthy return thanks to the short duration and a stronger dollar, even though the relevant index yielded an exceptionally poor return. The risk premiums on corporate loans remained steady in the first quarter giving VER a positive return on corporate bonds despite the increase in the underlying interest rate.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

The return on other fixed income investments was 1.8 per cent. Private credit funds returned 1.8 per cent and direct lending 1.8 per cent.

The impact of the COVID-19 pandemic was also reflected in the portfolios of private credit funds. The pandemic has caused major problems for companies engaged in lines of business that depend on travel. On the whole, it is safe to say that private credit managers have fared well during the COVID year and even benefitted from the market disruptions, as companies are increasingly looking for refinancing while banks are cutting down on lending to smaller businesses. The market has been extremely favourable for special situation managers in particular.

As in the previous years, the Q1 returns on private credit investments consists mostly of valuations updated at the turn of the year.

EQUITIES

Listed equities

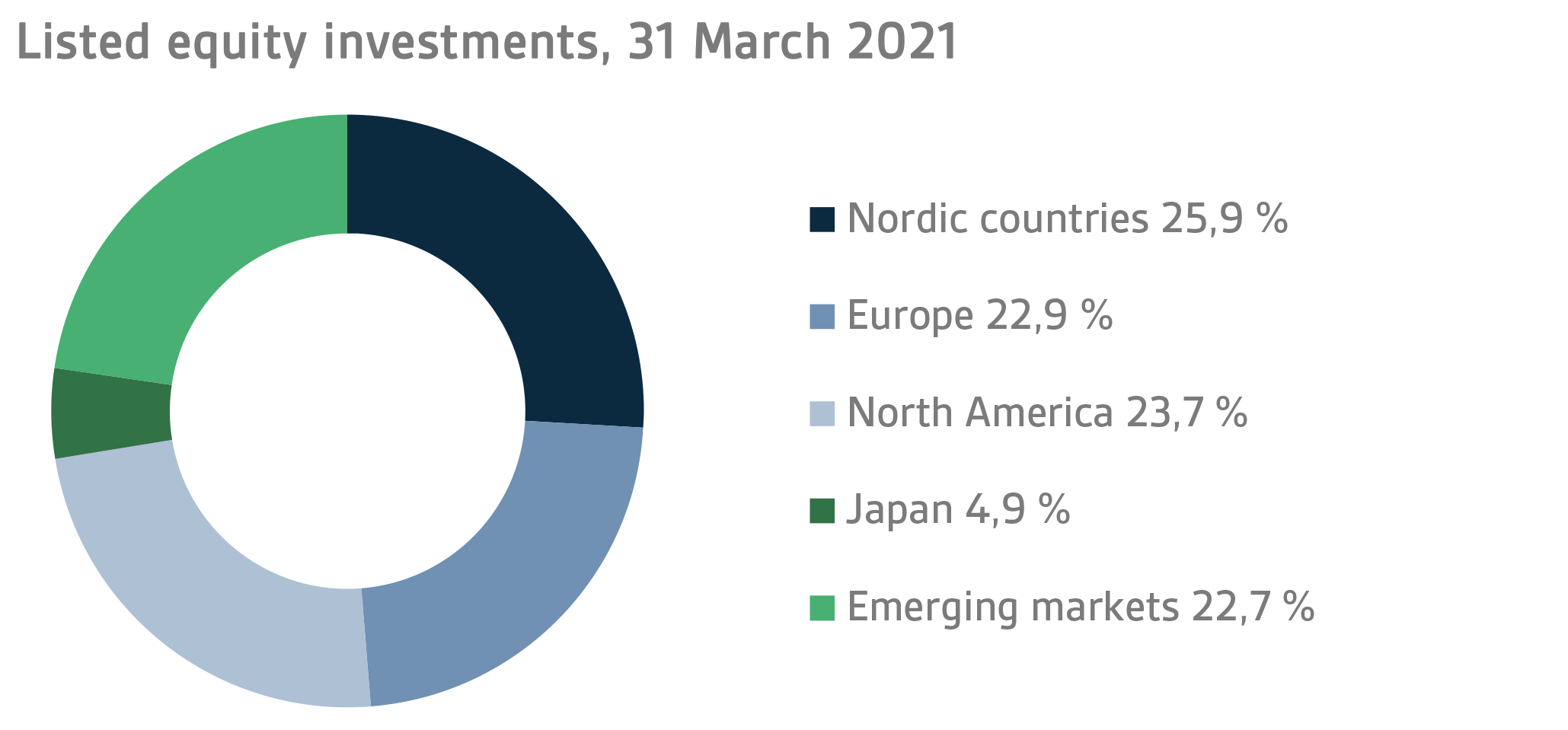

The return on listed equities during the first quarter was 9.4 per cent.

2021 got off to a brisk start in the stock market. Equities have given sound returns across the board as the world is bouncing back from COVID-19. While a lot of concerns still remain, not even bad news has been able to upset the mood in the stock market. As a result, the first quarter of 2021 proved to be one of the best quarters ever for equities, as returns on all portfolios turned clearly positive. The highest returns were generated by VER’s investments in the North American stock markets.

The world economy continued to recover during the first quarter of 2021. Financial performance by listed companies continues to beat forecasts while risk appetite remains strong. Equities usually perform well in such an environment, and this period is no exception. Admittedly, there were a lot of concerns during Q1, but they did not have any significant impact on the increase in stock prices. Additionally, the markets saw a major internal rotation during the first quarter, when value stocks fared better than growth stocks for the first time in a long time. However, there is still a substantial gap to be closed because the last few years have been extremely favourable for growth stocks, a development that was further underpinned by the spread of the pandemic last year. It remains to be seen whether this is just a momentary change or a sign of a more long-term trend in the stock market. An extensive vaccine roll-out after the recent minor setbacks would give a further boost to excellent financial performance by listed companies, which is also the prevailing consensus in the market. After all, economic growth is sorely needed because stock valuations remain high at the moment irrespective of the indicators used for measuring. It is true, however, that the options are few. Partly for this reason, money keeps flowing to the stock market despite high valuation levels.

Other equity investments

VER’s other equity investments include investments in private equity funds, non-listed stock and listed real estate investment trusts (REITs).

Private equity investments returned 9.6 per cent, unlisted equities 37.8 per cent and listed real estate investment trusts 5.9 per cent (TWR).

As in the past, the first-quarter returns on private equity funds represent returns actually earned in the last quarter of the previous year. Private equity funds benefitted from the positive development of stock markets towards the end of the year, and the valuation levels of portfolios increased during the last quarter. Although the impact of COVID-19 was reflected in some of the portfolio companies, they can be said to have done fairly well on the whole during this difficult time. Moreover, managers were able to carry out a number of extremely successful exits while valuations remain high despite the tough market conditions.

Listed real estate investment trusts followed the positive trend of the stock markets in the first quarter.

OTHER INVESTMENTS

VER’s other investments are investments in real estate, infrastructure, hedge funds and risk premium strategies.

The return on unlisted real estate funds was 1.0 per cent while infrastructure investments yielded 3.2 per cent.

In real asset classes, the Q1 returns are still updates on last year’s performance. In infrastructure, the impact of COVID-19 was mostly felt in travel-related investments whereas basic infrastructure investments were practically unaffected. Underlying the funds’ sound performance were rising valuation levels and extremely successful exits. With real estate investments, COVID-19 affected mostly commercial properties, but a cautiously positive trend could be detected in the real estate market towards the end of the year. The mood was sustained in the first quarter of 2021. Logistics and homes fared well whereas shopping centres and travel-related properties continued to be burdened by lockdown measures.

Hedge funds and systematic strategies gave a 2.0 per cent return in the first quarter. With hedge funds, the biggest positive contribution came from funds focusing on the Asian markets. Quantitative funds showed a high scatter of returns from +10% to -8%. The returns on systematic strategies were slightly negative, mainly due to the strengthening US dollar.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The State Pension Fund’s role in balancing government finances has grown and will continue to do so over the next few years. In 2020, the state’s pension expenditure totalled over EUR 4.8 billion while the 2021 budget foresees an expenditure of nearly EUR 4.9 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2021 budget will amount to about EUR 1.9 billion.

During the first quarter, VER transferred EUR 486 million to the government budget. Over the same period, VER’s pension contribution income totalled EUR 363 million. The pension contribution income matched the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

In June 2016, the Board of Directors of the State Pension Fund adopted a strategy that defines its long-term objectives in greater detail. The strategy foresees that the 25 per cent funding ratio target specified by law will be attained by 2033, if not earlier. To achieve this, it is imperative that VER’s pension contribution income remains at the estimated level and that the real return on investments remains relatively high. As the State’s pension liabilities amounted to EUR 93.1 billion at the end of 2020, the funding ratio was approx. 23 per cent. Additionally, the strategy sets out the principles by which the risk level and basic allocation of the investment portfolio are derived from the target funding ratio established for VER.

|

KEY FIGURES

|

|

|

|

31.3.2021

|

31.12.2020

|

|

Investments, MEUR (market value)

|

21 934

|

20 964

|

|

Fixed income investments

|

7 783

|

7 599

|

|

Equity investments

|

113 984

|

10 994

|

|

Other investments

|

2 241

|

2 280

|

|

Impact of derivatives

|

517

|

91

|

|

|

|

|

Breakdown of the investment portfolio

|

|

|

|

Fixed income investments

|

35,5 %

|

36,2 %

|

|

Equity investments

|

51,9 %

|

52,4 %

|

|

Other investments

|

10,2 %

|

10,9 %

|

|

Impact of derivatives

|

2,4 %

|

0,4 %

|

|

|

|

|

1.1.–31.3.2021

|

1.1.–31.12.2020

|

|

Return on investment

|

5,2 %

|

4,0 %

|

|

Fixed income investments

|

|

|

|

Liquid fixed income investments

|

-0,4 %

|

2,1 %

|

|

Other fixed income investments

|

1,8 %

|

4,4 %

|

|

Private Credit funds

|

1,8 %

|

3,9 %

|

|

Equity investments

|

|

|

|

Listed equity investments

|

9,4 %

|

6,2 %

|

|

Private Equity investments

|

9,6 %

|

6,6 %

|

|

Unlisted equity investments

|

37,8 %

|

12,2 %

|

|

Other investments

|

|

|

|

Non-listed Real Estate funds

|

1,0 %

|

1,2 %

|

|

Infrastructure funds

|

3,2 %

|

12,2 %

|

|

Hedge funds

|

2,0 %

|

4,9 %

|

|

|

|

|

Pension contribution income, MEUR

|

363

|

1 509

|

|

Transfer to state budget, MEUR

|

-486

|

1 931

|

|

Net contribution income, MEUR

|

-123

|

-423

|

|

Pension liability, BnEUR

|

|

93,1

|

|

Funding ratio, %

|

|

23 %

|

Additional information: CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel.: +358 (0)295 201 210

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of March 2021, the market value of the Fund’s investment portfolio stood at EUR 21.9 billion.

All figures presented in this interim report are preliminary and unaudited.