ANNUAL REPORT OF THE STATE PENSION FUND OF FINLAND 2024

Published 2025-02-13 at 14:32

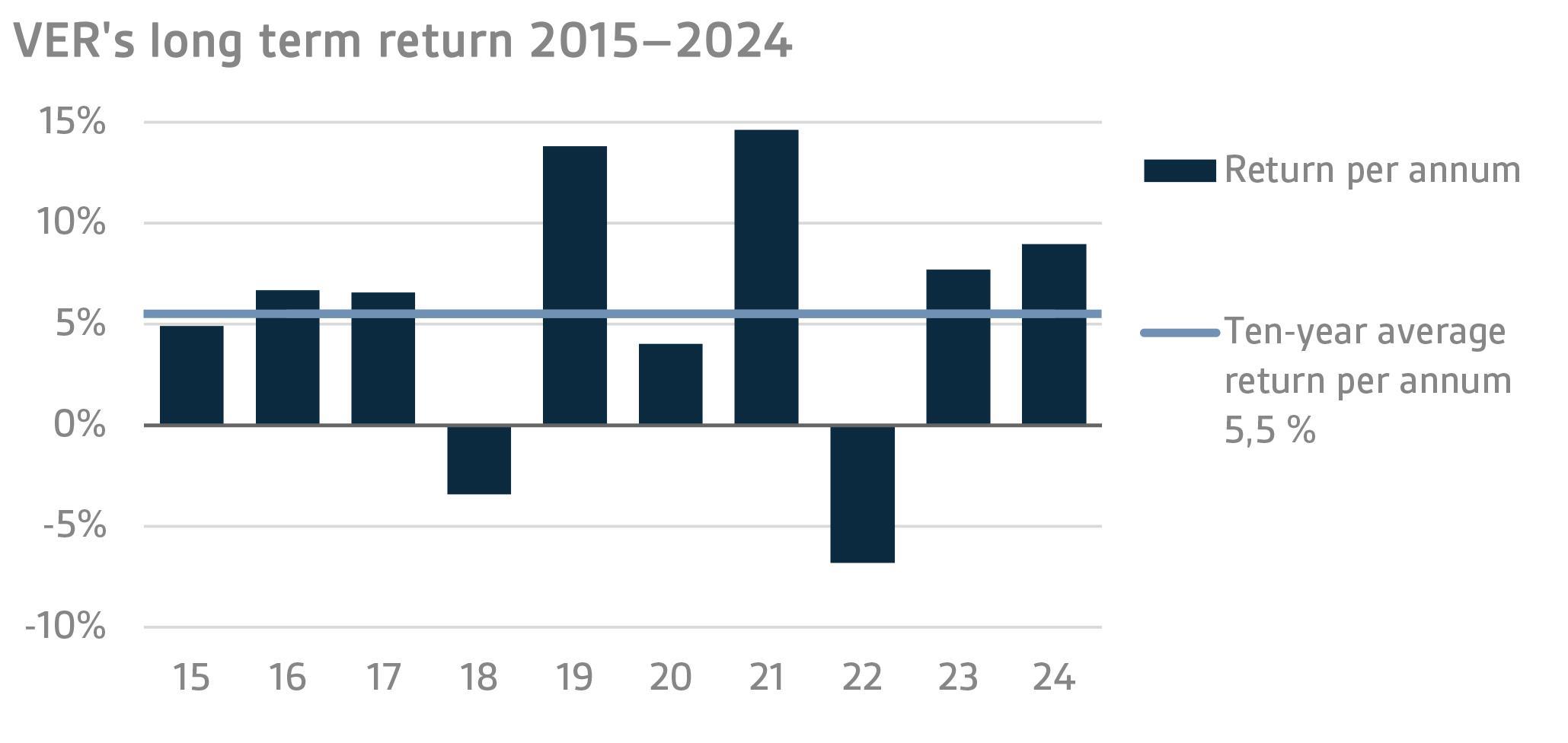

Return on investments 9.0% in 2024; ten-year average return 5.5%

INVESTMENT ENVIRONMENT

Despite a range of geopolitical uncertainties, the 2024 investment environment was favourable for the State Pension Fund of Finland. The state of the economy and monetary policy contributed to a sound investment market performance. Inflation rates fell in the euro area and the United States, approaching central banks' inflation targets of 2%. Additionally, the central bank policy rates were cut in 2024, permitting healthy returns on equities and fixed income investments. Economic growth was weak in the euro area and Finland, but the US economy thrived. The expectations regarding economic growth remain positive, creating a basis for favourable stock market performance.

However, the geopolitical situation continues to deteriorate. Acts of sabotage and cyber-attacks are becoming increasingly common in Europe. Although the geopolitical developments have caused momentary setbacks, the stock markets have recovered from them. International conflicts persist in Ukraine and the Middle East. Two years ago, the rise in energy prices caused an inflation shock that has now been overcome in the euro area. It was partly a natural development as the energy prices turned down.

2024 was a good year for investments. Nearly all asset classes generated better-than-expected long-term returns. The best performance was put in by US equities. By contrast, the weakest performance was delivered by real estate investment trusts, where returns continued to be weighed down by the unexpected increase in interest rates two years ago and the fall in demand for office space.

VER’S RETURN ON INVESTMENTS

At fair values, the total return on the investments made by the State Pension Fund of Finland (VER) in 2024 was 9.0 per cent. VER’s average rate of return was 5.4 per cent for the past five years and 5.5 per cent for the past ten years.

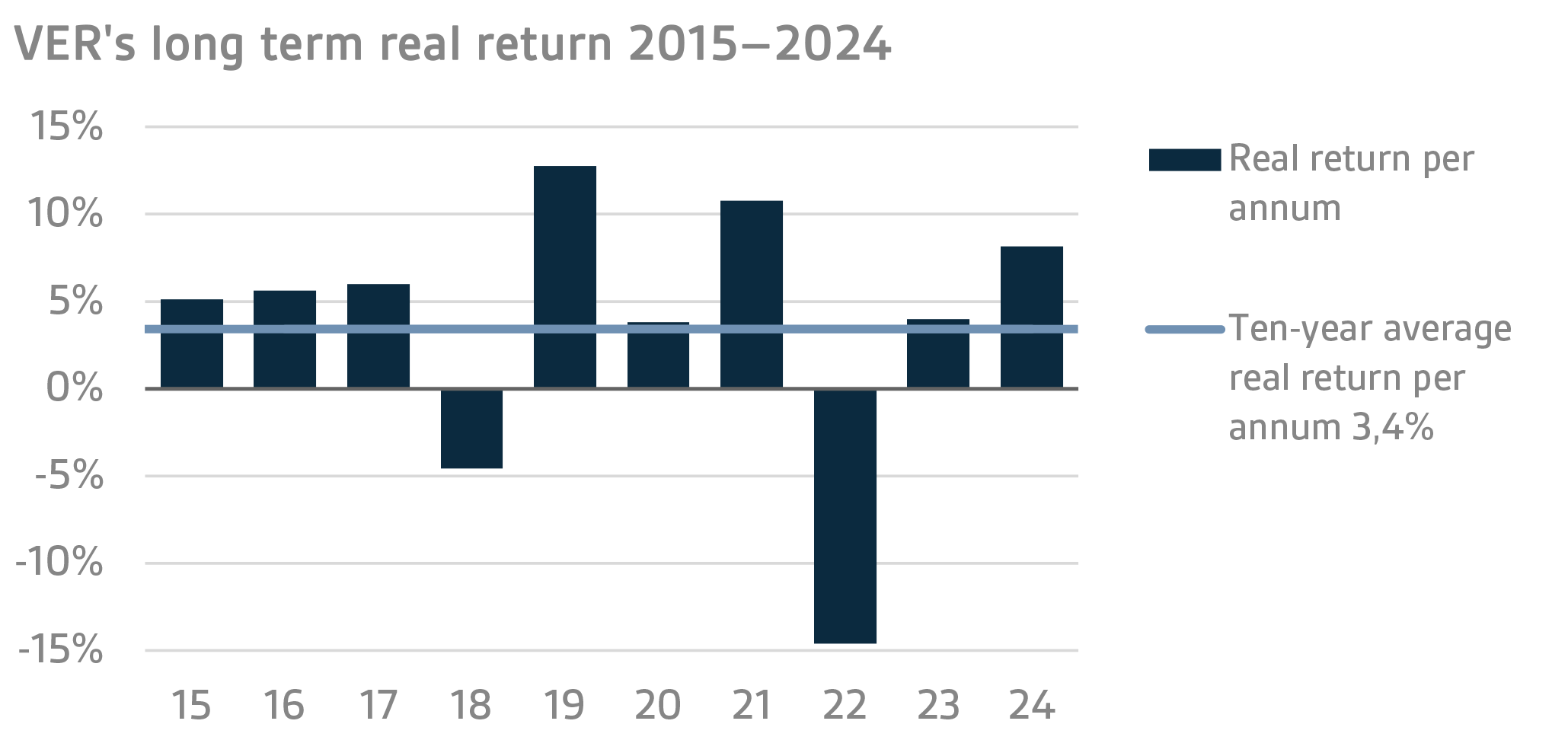

To determine real returns, the Finnish consumer price index was used as the inflation indicator. The real rate of return on investments in 2024 was 8.2 per cent. The five-year average real return was 2.0 per cent and ten-year real return 3.4 per cent.

According to the objective established by the Ministry of Finance, VER’s long-term return must exceed the average cost of net government debt. Over the past ten years, VER’s average market value weighted rate of return has beaten the cost of net government debt by 4.3 percentage points. Since 2001, when VER’s operations assumed their current form, the total returns earned by VER have exceeded the average cost of government debt by about EUR 12.1 billion.

A CLOSER LOOK AT 2024

VER’s two largest asset classes, liquid fixed income investments and listed equities, gave positive returns in 2024. The return on liquid fixed income instruments was 3.1 per cent and that of listed equities 14.6 per cent. Of the other asset classes, the best performance was put in by private equity funds at 13.4 per cent and infrastructure funds at 13.4 per cent.

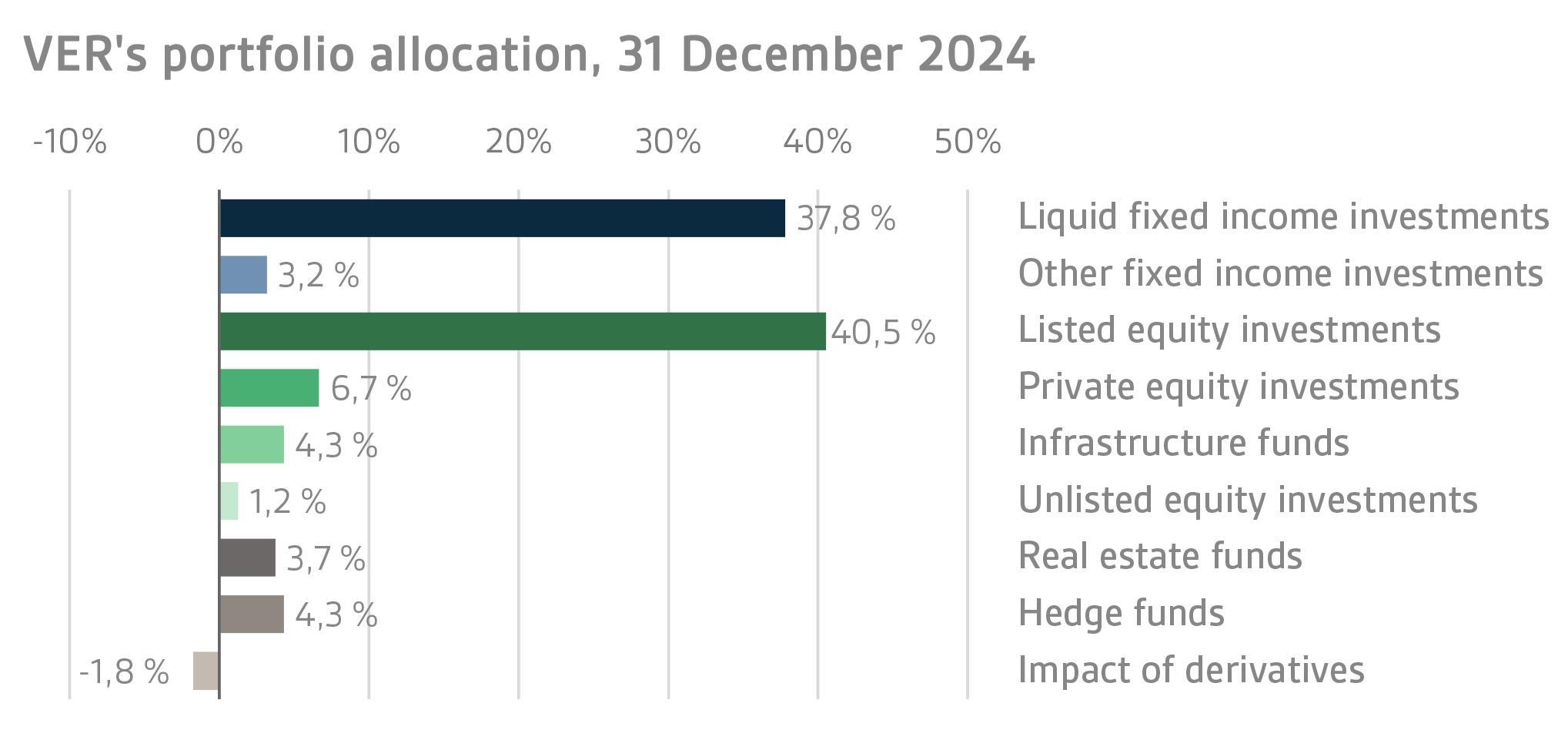

At the end of 2024, the market value of VER’s investment portfolio stood at EUR 24.2 billion. Of all the investments, fixed income instruments accounted for 41.0 per cent, equities 52.7 per cent and other investments 8.0 per cent of the total. The allocation effect of derivatives was -1.8 per cent.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

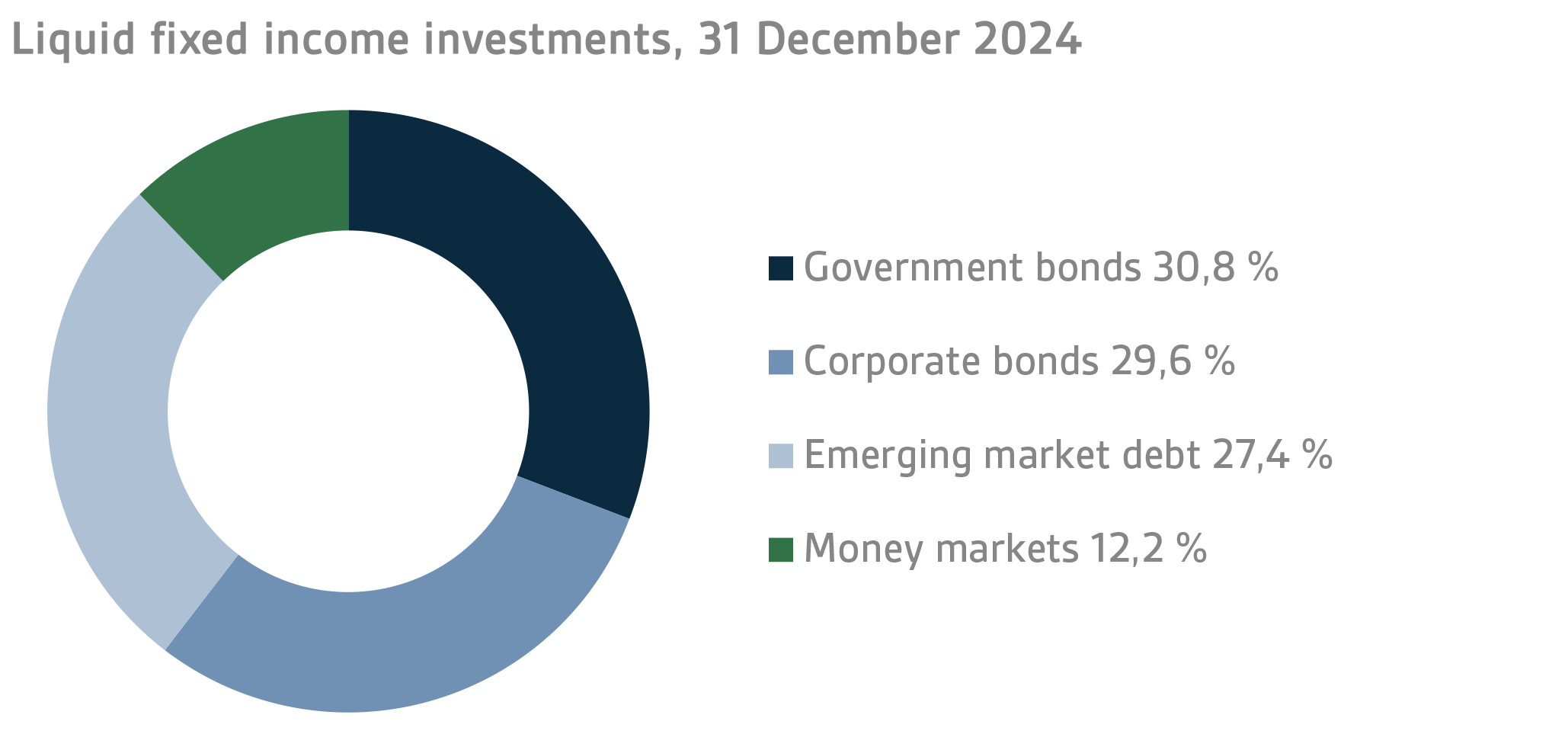

In 2024, the liquid fixed income investments returned 3.1 per cent and its risk-adjusted market value at the end of the year stood at EUR 9.2 billion. Towards the end of the year, the duration of the fixed income portfolio was close to the neutral duration of the benchmark index, while the modified duration of the convertible bond portfolio was 5.3 per cent.

There were substantial fluctuations in interest rates during the year and, despite central bank rate cuts, longer-term government bond rates rose during the year in both the euro area and the United States. By contrast, interest rates on euro-denominated interest rate swaps fell slightly from the levels prevailing in early 2024. During the reporting period, both the European Central Bank (ECB) and the US Federal Reserve (FED) cut policy rates by 100 basis points. The decisions were justified by the reduced inflation risks and deteriorating labour market situation. At the end of the year, the market was still foreseeing 25 basis-point cuts in rates, two for the FED and five for the ECB.

Towards the end of 2024, market rates were boosted by the slowdown in the downward inflation trend, more cautious comments from central banks on future policy rate cuts, and the concerns about the impact of Trump's election as US President on future inflation and the US fiscal deficit. As a result of the cuts in policy rates and rising long-term interest rates, the yield curve for both German and US 2–10 year government bonds turned upwards in the third quarter for the first time since 2022.

Concerns about economic developments, on the one hand, and fluctuations in interest rate expectations, on the other, caused risk premiums on corporate bonds and emerging debt markets to fluctuate. Despite this, risk premiums fell close to their lowest levels in years and, combined with high current yields, the returns on the riskier fixed income asset classes were very good in 2024. Of VER's liquid fixed income investments, the best returns were generated by lower-rated corporate bonds and investments in emerging market corporate bonds as well as emerging market government bonds denominated in local currencies.

Other fixed income investments

Other fix

ed income investments include investments in private credit funds and direct non-liquid loans. Most of the private credit funds in the portfolio are private equity funds investing in non-liquid loans. At the end of 2024, other fixed income investments accounted for 3.2 per cent of VER’s portfolio.

Private credit funds investing in floating rate bonds have benefited from the current interest rate environment. Although policy rates were cut during the year, overall interest rates remained quite high, which benefited the investment activities of private credit funds. An additional boost to sound performance was given by the moderate narrowing of loan margins. The best performance in the portfolio was delivered by the riskier strategies, such as special situation strategies, while returns were quite good across the board.

The return on other fixed income investments was 8.0 per cent in 2024. Private credit funds returned 8.5 per cent and direct loans 5.4 per cent. At the end of 2024, unfunded commitments totalled EUR 365 million.

EQUITIES

Listed equities

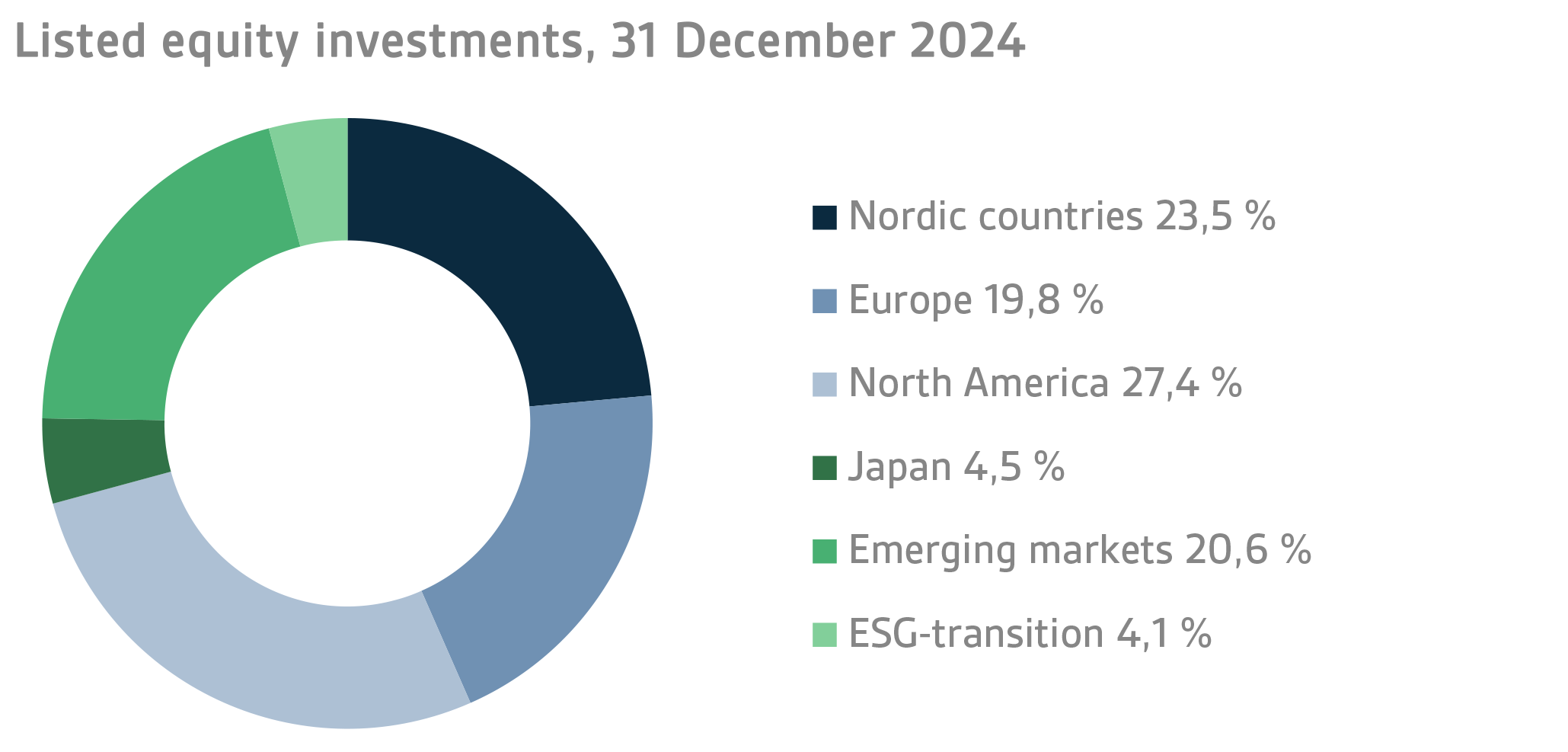

VER's listed equities performed well during 2024, having returned 14.6% by the end of the year. During the year, stock markets saw intermittent volatility, particularly in the third quarter, but corrections were short-lived and investors were quick to rediscover their optimism. Geopolitical tensions did not ease during the year, but they had little impact on stock market sentiment. Over the past year, several central banks started to ease monetary policy by lowering policy rates, which boosted optimism in stock markets. In the last quarter, the general trend in interest rates was upward, driven by changing inflation expectations, especially in the United States, but even this failed to have a significant impact on the mood in the market.

Listed companies performed increasingly well in the course of the year, although regional differences were fairly substantial. In the United States, listed companies put in a strong performance, thanks to large technology companies. Europe did clearly less well in this respect. The earnings growth of Finnish listed companies is expected to prove not only poor but negative in 2024, which was also reflected in the weak price performance of Finnish stocks in 2024. Of VER's investments in listed equities, the best returns were earned in the North American stock markets, while the worst performing investments were Nordic equities. The poor performance of Nordic stocks is explained, in particular, by Finnish equities, which delivered near-zero returns due to extremely weak earnings performance.

In terms of market capitalisation, the value of VER’s listed equities increased from EUR 9.5 to EUR 9.8 billion during 2024. At the end of the year, direct equity investments accounted for 21.6 per cent and fund investments 78.4 per cent of the total. At the end of 2024, VER held direct interests in 90 companies and fund units in a total of 61 funds.

Other equity investments

VER’s other equity investments include investments in private equity funds, infrastructure and unlisted stock. At the end of 2024, other equity investments accounted for 12.2 per cent of VER’s portfolio. Private equity investments returned 6.7 per cent, infrastructure investments

4.3 per cent and unlisted equities 1.2 per cent.

The first half of the year was quiet in the private equity transaction market, although some excellent exits were accomplished in VER's portfolio. Corporate valuations remained high throughout the year, driven by positive stock market performance and the good earnings performance of the portfolio companies. Towards the end of the year, there were clear signs of an upturn in the transaction market, and expectations for 2025 are cautiously optimistic.

The year-end return on private equity funds was 13.4 per cent. At the end of 2024, unfunded commitments totalled EUR 713 million.

Once again, infrastructure investments yielded excellent returns, driven by consistently high valuations, even though the increase in interest rates was expected to have a slightly negative impact on valuations. Growing investor interest in this asset class, accompanied by positive industry growth prospects and good earnings performance have contributed to the favourable trend in corporate valuations.

The all-year return on other fixed income investments was 13.4 per cent. At the end of 2024, unfunded commitments totalled EUR 283 million.

Investments in unlisted stocks consisted of investments in three companies. The year-end return on the portfolio was 3.9 per cent.

OTHER INVESTMENTS

VER’s other investments are made in real estate funds and hedge funds. At the end of 2024, other investments accounted for 8.0 per cent of VER’s portfolio. Of the invested assets, 3.7 per cent was placed in real estate funds and 4.3 per cent in hedge funds.

As in 2023, the reporting period was challenging for real estate investments. The impact of the rise in interest rates was reflected in real estate values, resulting in a significant slowdown in the transaction market. Returns on real estate investments remained negative at the end of the year, although tentative signs of a pick-up in the market were seen in the last months of the year. Funds investing in logistics performed as well as in the previous year, and their returns remained positive.

The return on investments in non-listed real estate funds was -5.0 per cent. At the end of 2024, unfunded commitments totalled EUR 425 million.

The return on hedge funds and systematic strategies reached 10.9 per cent in 2024. Overall returns were healthy across hedge fund strategies, as a year of strong market movements and widening yield spreads provided a favourable market environment for active strategies. The best annual returns were achieved by multi-strategy funds and quantitative funds, as well as equity-focused strategies. Macro funds, CTA and tail hedge strategies were the worst performers. Macro funds faced challenges during the year, in particular due to rapid market movements resulting from changes in interest rate expectations.

RESPONSIBLE INVESTING

The goal of VER’s responsible investment activities is to identify long-term ESG risks and support sustainable development. VER assesses ESG aspects together with other factors affecting the investment both at the time when the investment decision is made and during its lifecycle. In doing so, VER seeks to improve the risk-return ratio of its investments by reducing risks and exploiting the opportunities offered by the sustainability transition. VER's approaches to sustainability consist of investments based on its corporate values and international standards, ESG integration and the efforts to have an impact.

VER’s most important sustainability goal is the mitigation of climate change. VER’s principles for responsible investment address not only the climate risk but also other sustainability risks. To contribute to the attainment of the objectives set out in the Paris Agreement, VER seeks to achieve full carbon neutrality of its entire portfolio by 2050.

At the beginning of 2024, an ESG transition portfolio of global active funds was created in VER. The objective of the funds in the ESG transition portfolio is to change the ways companies operate through the exercise of influence, and by doing so to influence their carbon emissions, among other things.

VER publishes annual reports on the carbon footprint of the portfolio, i.e. the carbon intensity and absolute emissions of its portfolio of listed equities and corporate bonds. VER’s latest climate report was released in spring 2024. Aside from emissions, VER monitors the performance of its equities and fixed income portfolios in terms of relevant international standards.

VER is a member of organisations such as PRI, CDP and Finland’s Sustainable Investment Forum (FINSIF). As a signatory, VER reports regularly to the PRI on its sustainability activities. Beside membership, VER takes part in investor initiatives.

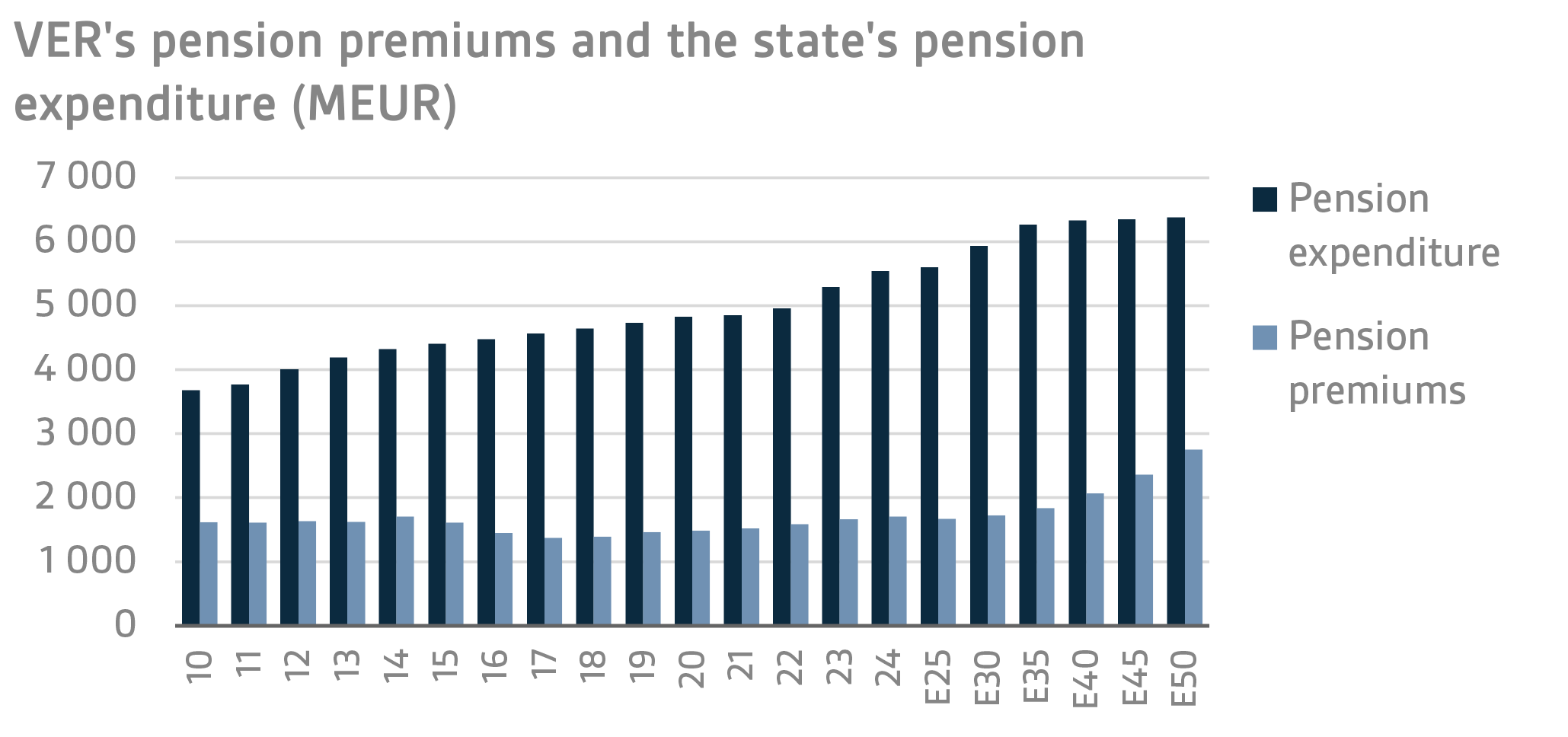

THE STATE’S PENSION EXPENDITURE CONTINUES TO INCREASE

The role of the VER in equalising the government’s pension expenditure continues to grow. In 2024, the State’s pension expenditure totalled a little over EUR 5.5 billion. As VER contributes 41 per cent towards these expenses to the government budget, the transfer to the 2024 budget amounted to approximately EUR 2.3 billion. Over the same period, VER received approximately EUR 1.7 billion in pension contributions. Its net pension contribution income has now turned permanently negative, meaning that more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

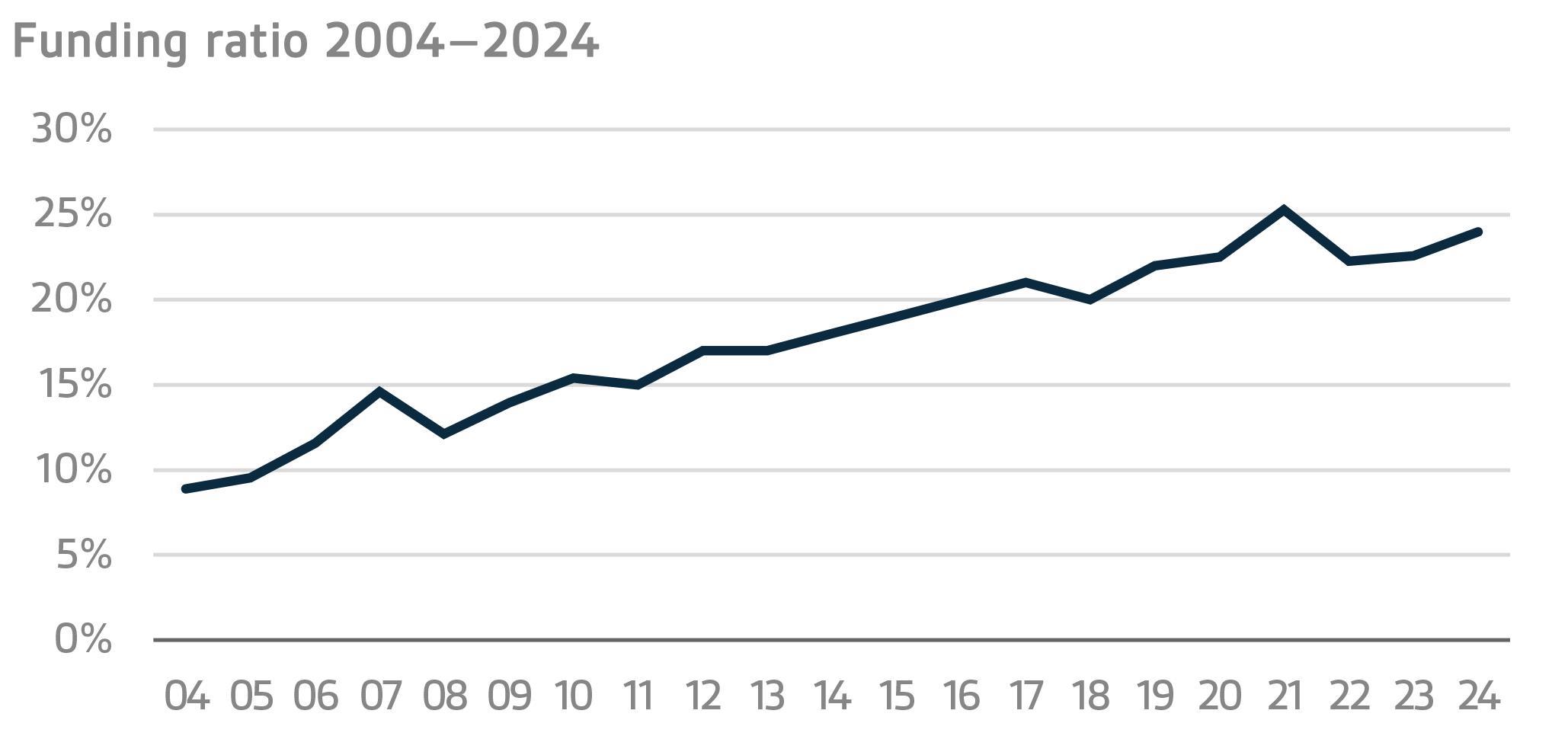

At the end of 2024, the State’s pension liabilities amounted to EUR 101.0 billion, while the funding ratio was 24.2 per cent. The Act on the State Pension Fund was amended in spring 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. Over the period from 2024 to 2028, the budget transfer will increase by one percentage point each year, from 40% to 45%. Hence, the 2024 budget transfer was 41%. If the funding ratio exceeds 25 per cent for two consecutive calendar years, an additional transfer of three percentage points will be made to the government budget.

The objectives set out in VER’s strategy create the basis for future investment activities. VER’s current strategy was approved on 24 January 2023. The baseline allocation of the investment portfolio is determined in the annual investment plan. Simulations suggest that the baseline allocation of the portfolio will achieve the long-term objectives established for VER.

VER'S ADMINISTRATION

The State Pension Fund of Finland, established in 1990, is an off-budget entity. Through VER, the State prepares for financing future pensions and seeks to equalise pension expenditure over time. By nature, VER is a buffer fund. VER’s assets are not used to pay out pensions directly; instead, all state pensions are paid out of the appropriations allocated for this purpose in the government budget.

The collection of pension contributions to the state pension system and related duties, such as the processing of pension applications and payment of pensions, are handled by the Local Government Pension Institution Keva. VER pays Keva a management fee for these services, which in 2024 amounted to about EUR 16.2 million.

The responsibility for oversight and control of VER’s operations rests with the Ministry of Finance, which is authorised to issue general instructions regarding the organisation of VER’s administration, financial management and the investment of its assets. According to the current operational guidelines issued by the Ministry of Finance (dated 9 Aug 2022), equity investments must not exceed 60 per cent of the value of VER’s portfolio. Fixed income instruments must account for a minimum of 30 per cent, and liquid and low-risk fixed income instruments for a minimum of 20 per cent of the value of the portfolio. Other investments must not exceed 15 per cent of the value of the portfolio at the time the investment is made. Real estate investments must be made in the form of fund investments or equivalent indirect investments.

VER’s Board of Directors is appointed by the Ministry of Finance. The Board has seven members, three of whom are appointed from among candidates proposed by central staff organisations of government employees. Vesa Vihriälä, Doctor of Political Science, serves as Chair and member of the Board of Directors. The Chair of the Investment Advisory Committee is Jussi Laitinen.

VER’s operating costs in 2024 amounted to EUR 8.9 million, which represents 0.04 per cent of its average annual capital. During the year VER had an average of 28 employees. Job satisfaction at VER is good. VER invests in human resources and offers ample opportunities for skills development, which is important both in seeking maximum returns on investments and in managing risks.

KEY FIGURES

|

|

|

|

|

|

|

|

|

2024

|

2023

|

|

Return on investments

|

9.0 %

|

7.7 %

|

|

Real return

|

8.2 %

|

4.0 %

|

|

|

|

|

|

Return by asset class

|

|

|

|

fixed income investments

|

|

|

|

Liquid fixed income investments

|

3.1 %

|

6.9 %

|

|

Private credit funds

|

8.5 %

|

8.5 %

|

|

Direct lending

|

5.4 %

|

4.9 %

|

|

Equities

|

|

|

|

Listed equities

|

14.6 %

|

11.3 %

|

|

Private equity funds

|

13.4 %

|

5.0 %

|

|

Infrastructure funds

|

13.4 %

|

6.8 %

|

|

Unlisted equities

|

3.9 %

|

6.0 %

|

|

Other investments

|

|

|

|

Unlisted real estate funds

|

-5.0 %

|

-6.8 %

|

|

Hedge funds and systematic strategies

|

10.9 %

|

3.2 %

|

|

|

|

|

|

Average returns

|

5 years

|

10 years

|

|

|

|

|

|

Average return on portfolio p.a.

|

5.4 %

|

5.5 %

|

|

Average real return p.a.

|

2.0 %

|

3.4 %

|

|

Average effective interest rate on government debt p.a.

|

1.1 %

|

1.2 %

|

|

|

|

|

|

Portfolio allocation

|

2024

|

2023

|

|

|

|

|

|

Total investments, EURm

|

24 240.1

|

22 802.9

|

|

|

|

|

|

fixed income investments

|

41.0 %

|

40.3 %

|

|

Liquid fixed income investments

|

37.8 %

|

37.0 %

|

|

Other fixed income investments

|

3.2 %

|

3.3 %

|

|

Equity investments

|

52.7 %

|

53.3 %

|

|

Listed equities

|

40.5 %

|

41.5 %

|

|

Other equity investments

|

12.2 %

|

11.7 %

|

|

Other investments

|

8.0 %

|

8.0 %

|

|

Unlisted real estate funds

|

3.7 %

|

3.9 %

|

|

Hedge funds and systematic strategies

|

4.3 %

|

4.1 %

|

|

Key figures

|

2024

|

2023

|

|

|

|

|

|

Volatility

|

5.5 %

|

6.7 %

|

|

Sharpe ratio

|

1.1

|

0.8

|

|

|

|

|

|

Other key figures

|

2024

|

2023

|

|

|

|

|

|

Pension contribution income, EURm

|

1 709

|

1 679

|

|

Budget transfers, EURm

|

2 274

|

2 116

|

|

Net contribution income, EURm

|

-565

|

-437

|

|

Balance sheet total, EURm

|

17 683

|

17 291

|

|

Pension liabilities, EUR bn

|

101.0

|

101.0

|

|

Funding ratio

|

24.2 %

|

22.7 %

|

Additional information:

Additional information is provided by Chief Executive Officer

Timo Löyttyniemi

, firstname.lastname@ver.fi, tel. +358 295 201 210.

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of 2024, the market value of the Fund’s investment portfolio stood at EUR 24.2 billion.