VER’s return on investment 7.8% during 1 Jan–30 Sept 2024; ten-year average annual return 5.5%

Published 2024-10-30 at 14:22

INVESTMENT ENVIRONMENT

Economic developments and interest rates have favoured equity markets and investment returns. Although economic growth has not been brisk, corporate earnings – considering the circumstances – have proved sufficient to keep stock markets strong. The general level of interest and slightly falling rates have contributed to generous interest income. Additionally, shrinking risk premia have generated extra returns on fixed income instruments.

The falling inflation rate in the course of 2024 has fuelled expectations of monetary policy easing. The European Central Bank cut interest rates for the first time by -0.25% in June, followed by further cuts later on, while the US Federal Reserve lowered its rates by -0.5% in September. For stock markets, this meant favourable price performance, despite the divergent views on the direction of the economy. Confidence is strong in that falling interest rates will support economic recovery in Europe and that growth in the USA will slow down, which will permit additional interest rate cuts.

Geopolitical tensions persist in many regions. Russia's war of aggression in Ukraine, together with the Houthis, Hamas, Hezbollah and Iran, have created a war-like situation with no easy solutions in sight. Efforts to achieve a peaceful solution make the headlines from time to time, but no concrete decisions have been taken. Geopolitical uncertainty is not only a crisis created by regional conflicts, but also a manifestation of competition between different systems. However, geopolitical tensions have failed to upset the stock markets, except occasionally. Any dips have been followed by a swift recovery driven by strong market demand and liquidity.

While the development of the Finnish economy has followed the international business cycle, it has also been affected by a number of unfavourable isolated trends. The growth prospects of Finnish companies have been adversely affected by Russia’s complete and China’s potential economic separation from the western markets as well as weak economic growth in Germany. There is a strong will to seek new growth, but actions have often been isolated and limited in their impact. Achieving international growth and easing geopolitical tensions are key to the future success of businesses in this respect.

VER’S RETURN ON INVESTMENTS

Future monitoring and evaluation of the VER’s investment activities will focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments.

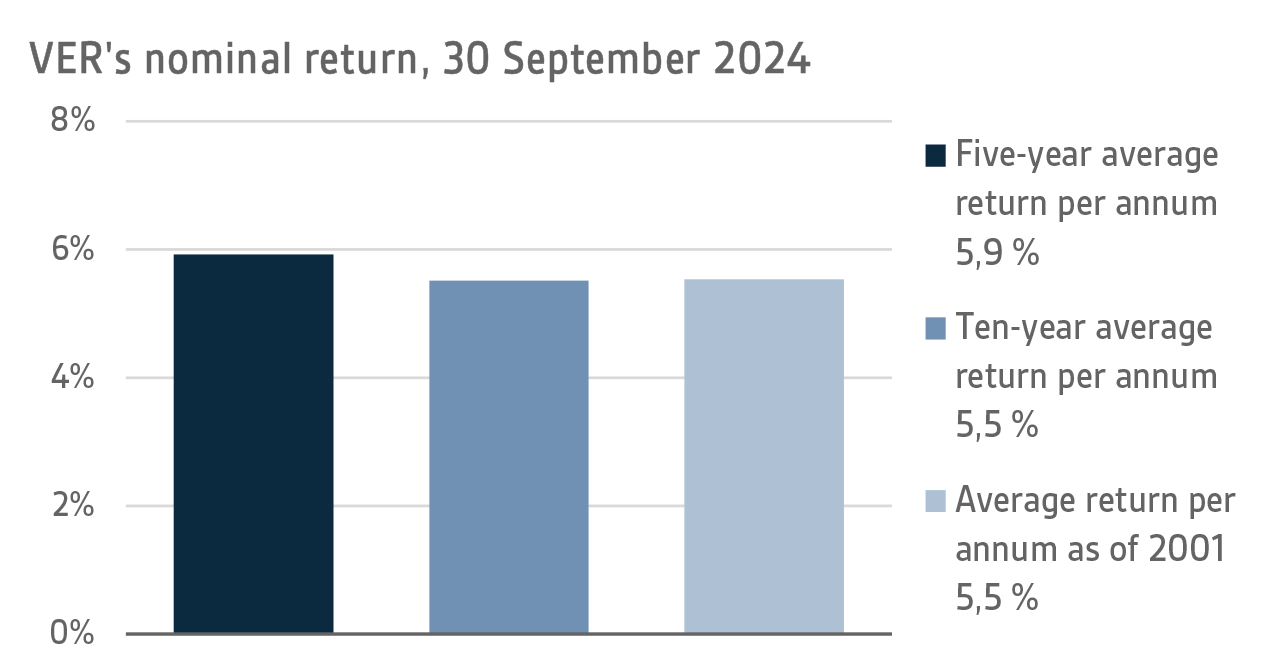

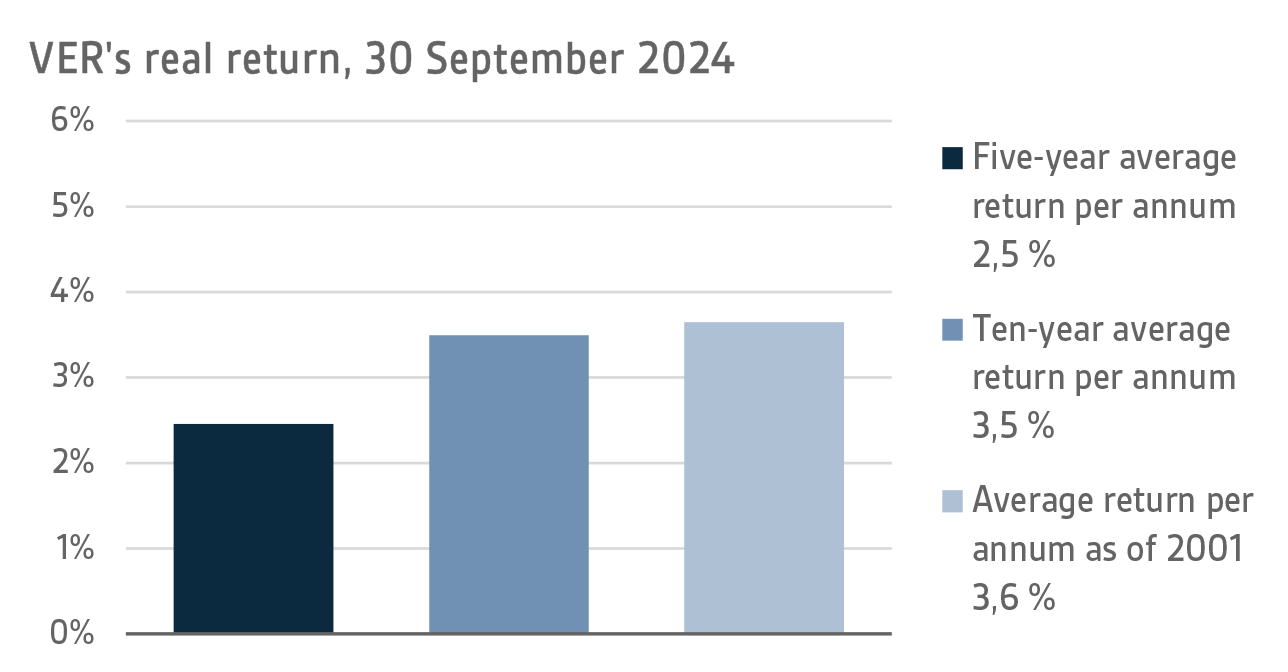

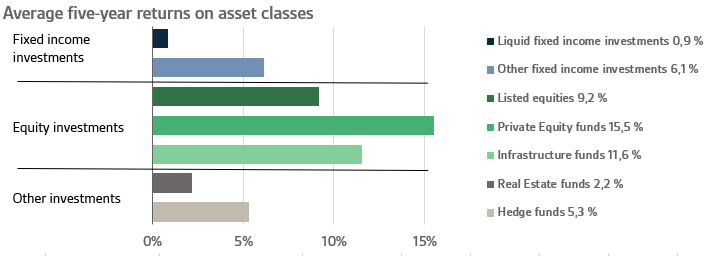

On 30 September 2024, VER’s investment assets totalled EUR 24.1 billion. During the first three quarters, the return on investments at fair values was 7.8 per cent. The average nominal rate of return over the past five years (1 October 2019–30 September 2024) was 5.9 per cent and the annual ten-year return 5.5 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.5 per cent.

The real rate of return during the first three quarters was 7.1 per cent. VER’s five-year average real return was 2.5 per cent and ten-year real return 3.5 per cent per year. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 3.6 per cent.

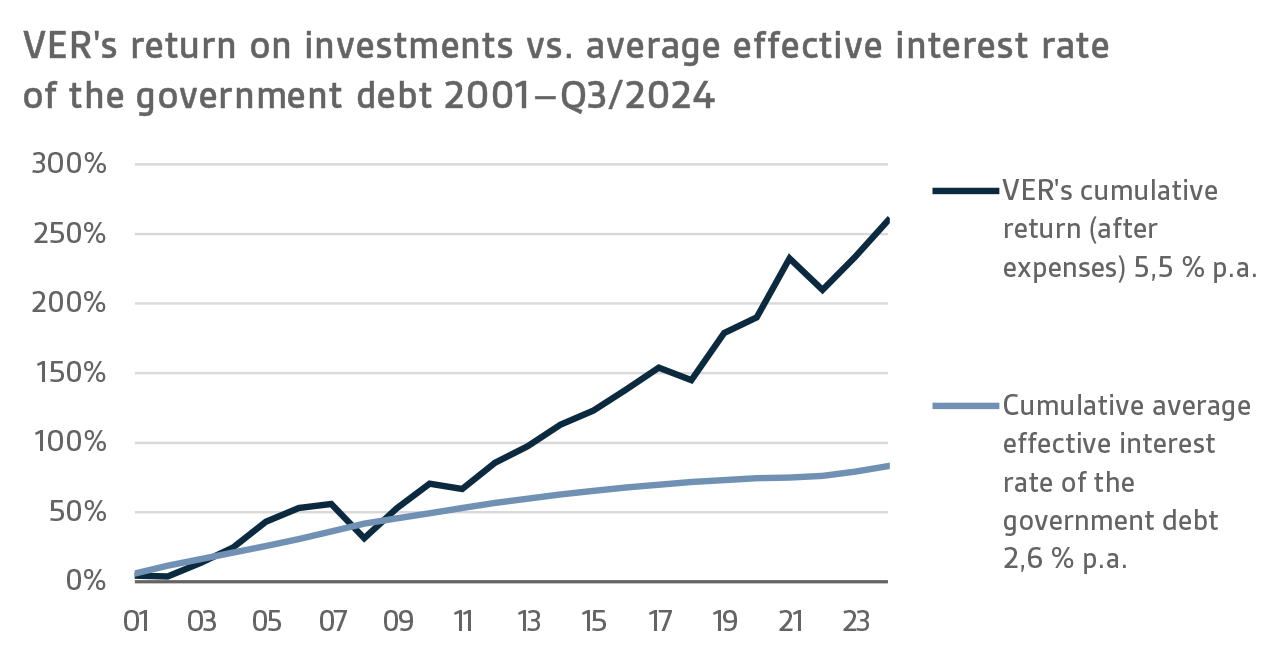

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 4.3 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 11.9 billion over the same period.

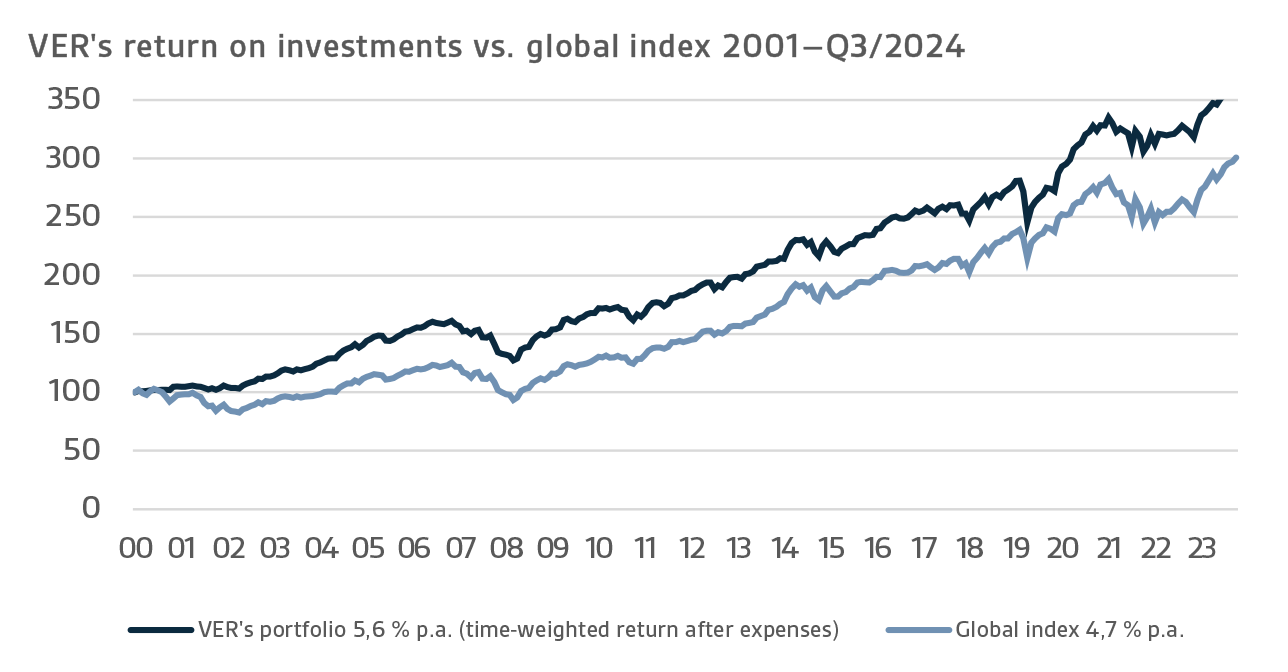

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged fixed income instruments is 50 per cent.

A CLOSER LOOK AT JANUARY–SEPTEMBER 2024

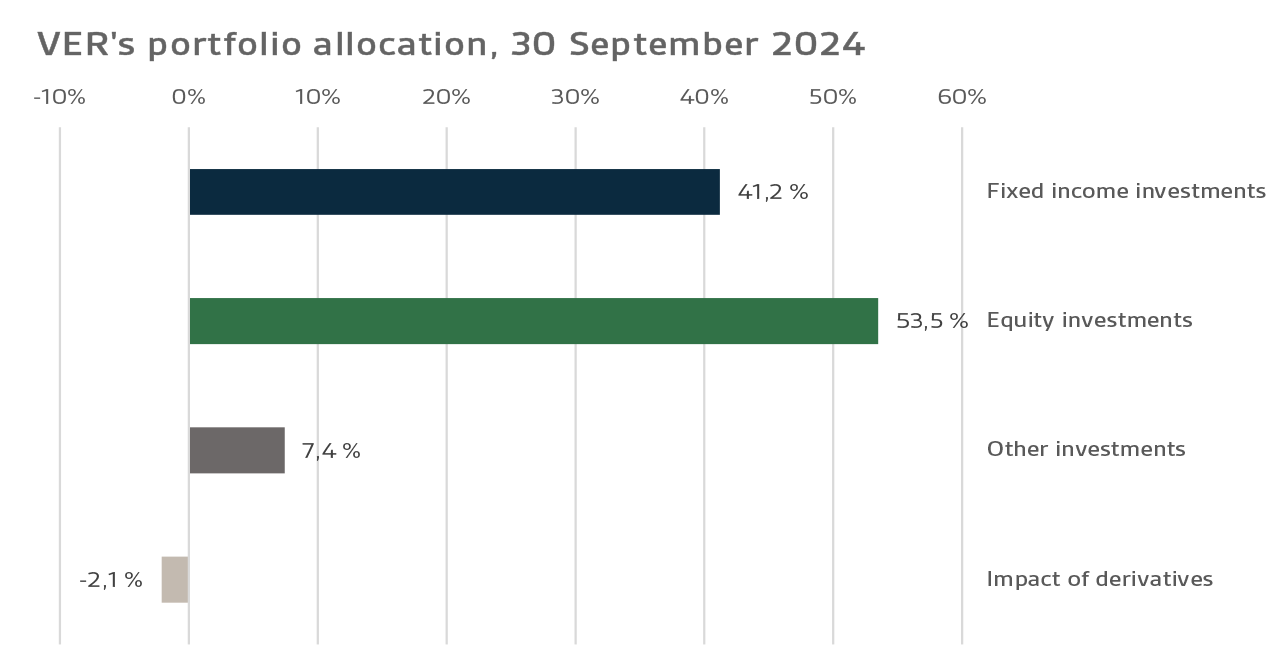

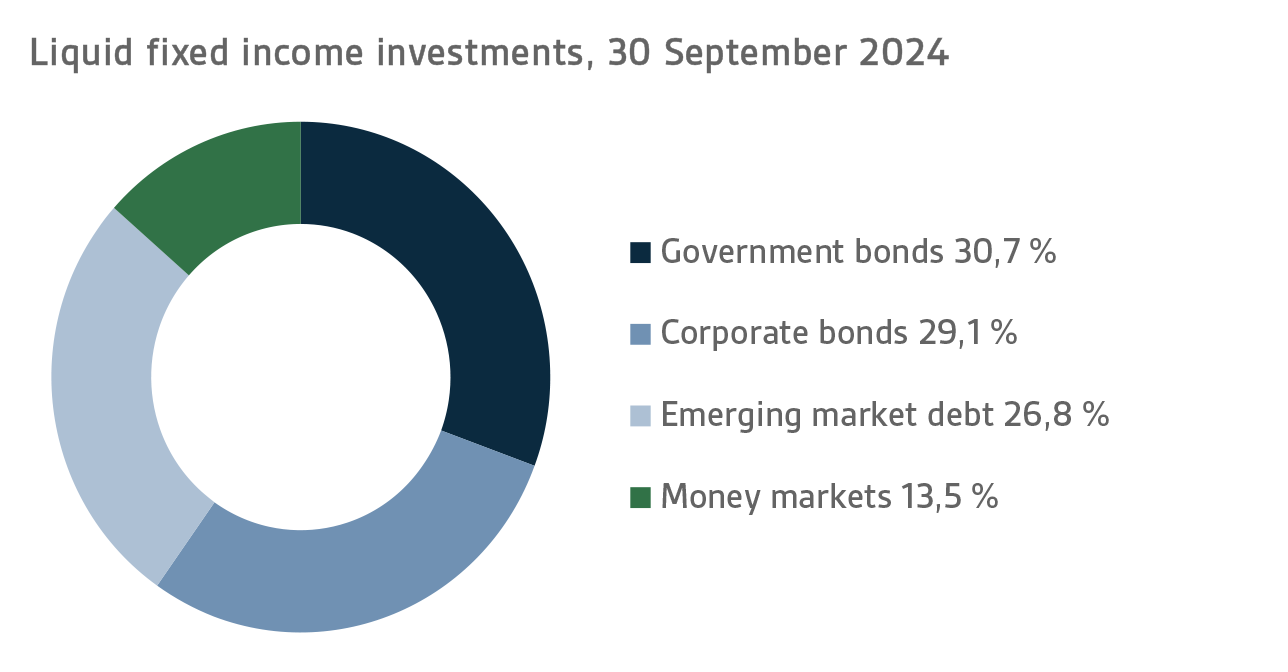

In accordance with the guidelines of the Ministry of Finance, VER’s investments are divided into fixed income investments, equities and other investments. At the end of September, fixed income instruments accounted for 41.2 per cent, equities 53.5 per cent and other investments 7.4 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of 3.4 per cent and listed equities 14.1 per cent during the first three quarters.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

During the first three quarters of 2024, the return on liquid fixed income instruments was 3.4 per cent.

After a bumpy start to the year, government bond rates fell significantly in the third quarter. Central banks were no longer as concerned about inflation as before, while concerns about the US economy falling into recession increased. In particular, the Federal Reserve Bank of the United States (FED) stressed that it is closely monitoring developments in the labour market.

The weak US employment report in early August boosted expectations of central bank rate cuts and, as expected, both the European Central Bank (ECB) and the Federal Reserve lowered their policy rates at their September meetings. The ECB cut its refinancing rate by 25 basis points to 3.50 per cent. At the same time, the spread between the deposit rate and the rate on the main refinancing operations was narrowed from 50 interest rate points to 15, as announced in March. The ECB indicated that future decisions would depend on the economic data to be published.

The Federal Reserve, in turn, lowered its policy rate by 50 basis points to a range of 4.75%-5.00%. The decision was justified by the reduced inflation risks and the deterioration in the labour market situation. Aside from the rate cuts already implemented, FED members foresaw another 50-point cut towards the end of 2024, as opposed to a previous expectation of a 25-point cut. As far as 2025 is concerned, the median expectation was 100 basis points, but the differences between individual members were not great.

In addition to interest rate cuts by central banks, market expectations of future rate cuts increased significantly in the third quarter. While at the end of June markets were pricing in both the ECB and the FED rate cuts by around 40 basis points for the rest of the year, at the end of September markets were expecting the FED to cut rates by another 65 basis points and the ECB by around 50 basis points on top of the September rate cuts. As a result of rising near-term interest rate expectations, the yield curve for both German and US 2-10 year government bonds turned upwards for the first time since 2022.

Concerns about the economic outlook and rising interest rate expectations, on the other hand, caused risk premia for corporate bonds and emerging market debt to fluctuate, but good current yields and a decline in underlying interest rates resulted in excellent returns for the riskier fixed income asset classes over the first three quarters. Of VER's liquid fixed income investments, the best returns were generated by investments in emerging market corporate bonds and emerging market USD-denominated government bonds, as well as lower-rated corporate bonds.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

The return on other fixed income investments was 5.3 per cent. Private credit funds returned 5.6 per cent and direct lending 3.8 per cent.

Private credit funds investing in floating rate bonds have benefited from rising interest rates in the current year. Demand for private corporate finance has also been on the rise, especially in Europe, which has improved the market position of private credit providers and allowed for relatively favourable loan terms for lenders. The record high level of uncalled capital in private equity funds will continue to strengthen the market position of private credit funds in the coming years.

EQUITIES

Listed equities

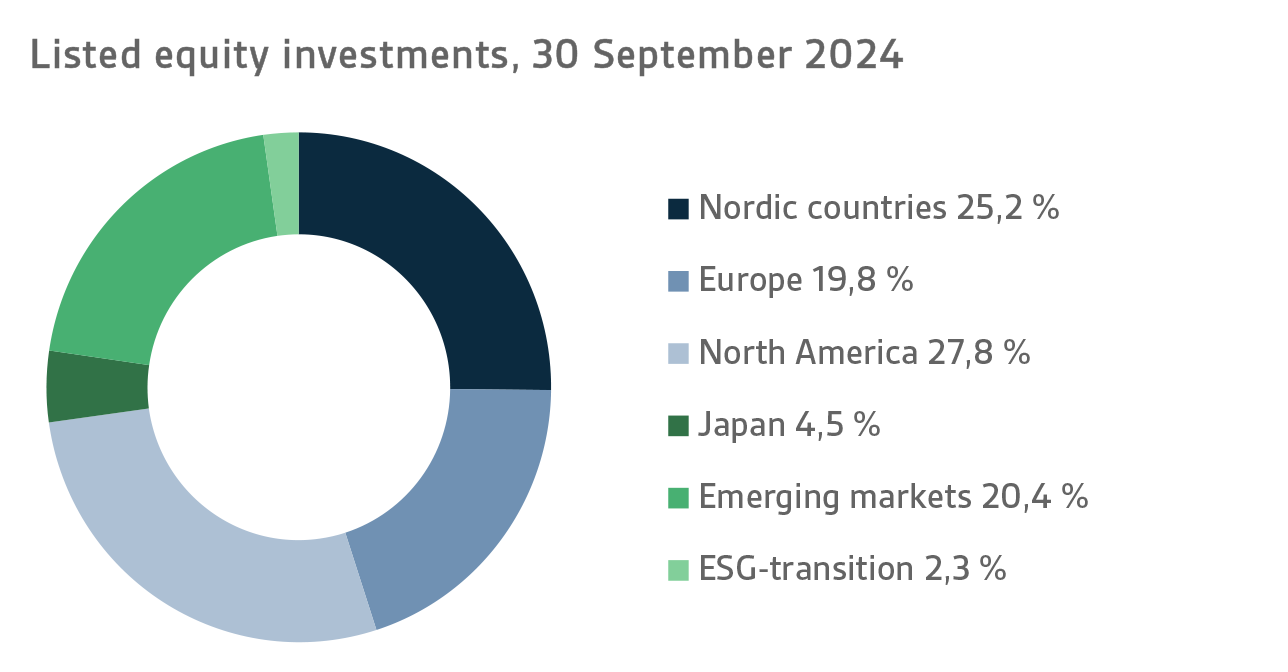

At the end of the reporting period, the return on listed equities was 14.1 per cent.

Equities continued to perform well in the third quarter of 2024, and by the end of the reporting period, the return for 2024 had already reached an extremely sound level. Last summer saw some major swings in the global stock markets, but the downward corrections have so far been relatively short-lived. The stock market optimism was not even dampened by the increasing geopolitical tensions towards the end of the period, especially in the Middle East. During the third quarter of the year, interest rates were falling in both the US and Europe, another factor that contributed to the positive stock market sentiment. The financial results reported by listed companies have also been in line with expectations during the year, so major disappointments have been avoided at least for now.

VER's best returns continued to come from North American equity markets, although the gap with other regions narrowed slightly during the third quarter. The weakest performance was put in by the investments made in the Nordic equity market. However, their return was the best among VER's sub-portfolios in the third quarter, due to the strong performance of Finnish equities during the summer after a very weak start to the year. News in late September of the massive economic stimulus measures planned by the Chinese government gave a boost to Chinese stock markets. Share prices rose significantly in a couple of weeks, albeit from relatively low levels. If the stimulus measures prove successful, it would also benefit many other parties, such as the Finnish export industry. This too contributed to the strong return on Finnish equities towards the end of the period.

Other equity investments

VER’s other equity investments include investments in private equity funds, infrastructure and unlisted equities.

Private equity investments returned 5.9 per cent, infrastructure funds 5.3 per cent and unlisted equities 4.2 per cent.

Private equity funds continued in the wait-and-see mode. The transaction market has remained rel

atively quiet, although some managers pulled off excellent exits. Even so, the number of exits remained moderate. Partly driven by the positive performance of stock markets, company valuations remained at sound levels. Valuations were also boosted by the surprisingly strong performance of the underlying companies, despite higher financing costs.

The rise in interest r

ates had a relatively limited impact on returns on infrastructure investments. Companies succeeded in passing on the increased financing costs to retail prices. As in the case of private equity investments, corporate valuations remained high. Although investor interest in value-add strategies has been growing, the majority of institutions will continue to invest in cash-flow generating core/core+ funds in the coming years.

OTHER INVESTMENTS

VER’s other investments include investments in real estate investment trusts, hedge funds and systematic strategies.

The return on investments in unlisted real estate funds was -5.8 per cent.

The rise in interest rates over the past year has significantly eroded returns on real estate investments as a result of higher yield requirements. Market sentiment appears to have improved slightly, and some real estate sectors are believed to have bottomed out. Towards the end of the year, falling interest rates should have a positive impact on property values as owners revalue their properties in November and December.

Hedge funds and systematic strategies gave a 6.6 per cent return during the first three quarters.

Hedge fund returns in the first three quarters were excellent, both in absolute and relative terms. Of the portfolio funds, the macro funds did well in the third quarter, reversing their lacklustre performance in the first half of the year to achieve sound returns. Similarly, Event Driven strategies had a strong quarter, whereas Quantitative and Equity Risk strategies had a challenging third quarter, generating the weakest returns of the portfolio investment styles. In direct derivative strategies, additional returns were earned from currency and credit derivative strategies.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The role of the State Pension Fund in balancing the government’s pension expenditure continues to grow. In 2023, the State’s pension expenditure totalled over EUR 5.3 billion while the 2024 budget foresees an expenditure of nearly EUR 5.6 billion. As VER contributes 41 per cent towards these expenses to the government budget, the transfer to the 2024 budget will amount to over EUR 2.3 billion.

By the end of September, VER had transferred EUR 1.7 billion to the government budget. Over the same period, VER’s pension contribution income totalled EUR 1.3 billion. The pension contribution income matches the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. According to current estimates, this gap between budget transfers and income will continue to grow up to the mid-2030s, which will slow down the growth of the Fund. The negative cash flow is expected to continue until the 2050s.

The Act on the State Pension Fund was amended in spring 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. Consequently, VER’s budget transfers will be gradually increased from the current 41 per cent to 45 per cent during 2024–2028. If the funding ratio exceeds 25 per cent for two consecutive calendar years, an additional transfer of three percentage points will be made to the government budget.

|

KEYFIGURES

|

|

|

|

|

30.9.2024

|

31.12.2023

|

30.9.2023

|

|

Investments, MEUR (market value)

|

24 138

|

22 803

|

21 965

|

|

Fixed income investments

|

9 942

|

9 180

|

9 159

|

|

Equity investments

|

12 907

|

12 150

|

11 510

|

|

Other investments

|

1 798

|

1 824

|

1 866

|

|

Impact of derivatives

|

-509

|

-351

|

-571

|

|

|

|

|

|

Breakdown of the investment portfolio

|

|

|

|

|

Fixed income investments

|

41,2 %

|

40,3 %

|

41,7 %

|

|

Equity investments

|

53,5 %

|

53,3 %

|

52,4 %

|

|

Other investments

|

7,4 %

|

8,0 %

|

8,5 %

|

|

Impact of derivatives

|

-2,1 %

|

-1,5 %

|

-2,6 %

|

|

|

|

|

|

1.1.–30.9.2024

|

1.1.–31.12.2023

|

1.1.–30.9.2023

|

|

Return on investment

|

7,8 %

|

7,7 %

|

3,2 %

|

|

Fixed income investments

|

|

|

|

|

Liquid fixed income investments

|

3,4 %

|

6,9 %

|

2,1 %

|

|

Private Credit funds

|

5,6 %

|

8,5 %

|

4,2 %

|

|

Return on investment

|

3,8 %

|

4,9 %

|

3,7 %

|

|

Equity investments

|

|

|

|

|

Listed equity investments

|

14,1 %

|

11,3 %

|

4,6 %

|

|

Private Equity investments

|

5,9 %

|

5,0 %

|

4,0 %

|

|

Infrastructure funds

|

5,3 %

|

6,8 %

|

5,1 %

|

|

Unlisted equity investments

|

4,2 %

|

6,0 %

|

5,9 %

|

|

Other investments

|

|

|

|

|

Unlisted Real Estate funds

|

-5,8 %

|

-6,8 %

|

-2,3 %

|

|

Hedge funds and systematic strategies

|

6,6 %

|

3,2 %

|

1,9 %

|

|

|

|

|

|

Pension contribution income, MEUR

|

1 300

|

1 679

|

1 276

|

|

Transfer to state budget, MEUR

|

1 715

|

2 116

|

1 595

|

|

Net contribution income, MEUR

|

-415

|

-437

|

-319

|

|

Pension liability, BnEUR

|

|

101

|

|

|

Funding ratio, %

|

|

22,7 %

|

|

Additional information: CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 (0)295 201 210

Established in 1990, the State Pension Fund of Finland (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of September 2024, the market value of the Fund’s investment portfolio stood at EUR 24.1 billion.

All figures presented in this interim report are preliminary and unaudited.