INVESTMENT ENVIRONMENT

War broke out in Europe in the first quarter of 2022 when Russia attacked Ukraine on 24 February 2022. The assault has led to extensive human suffering in Ukraine and launched a wave of refugees to other European countries. Additionally, the war has impacted the European economy, the inflation rate as well as stock and fixed income markets. The attack was soon followed by sanctions imposed by the West and high energy prices, while potential further developments will greatly affect the dynamics of the economy and investment markets.

Inflation remained high throughout the first few months of the year, driven mostly by increasing energy prices. The inflation rate was reflected on the fixed income markets. Expectations of a tighter monetary policy on the part of central banks gained ground and interest rates went up during the first quarter.

As a result of the war in Ukraine, uncertainty remained high and several agencies revised down their economic forecasts for 2022. All the economic impacts of the war are not yet known and will depend on the duration and extent of the hostilities. European countries will invest more in renewable energy and defence materiel, with the result that sovereign debt financing needs can be expected to increase.

In this changed geopolitical context, the energy policy in Europe, and indeed across the entire Western world, underwent a transformation. Europe's dependence on Russian oil and natural gas is being reassessed and there is a growing interest in the renewable energy sources necessary for the green transition.

VER's RETURN ON INVESTMENTS

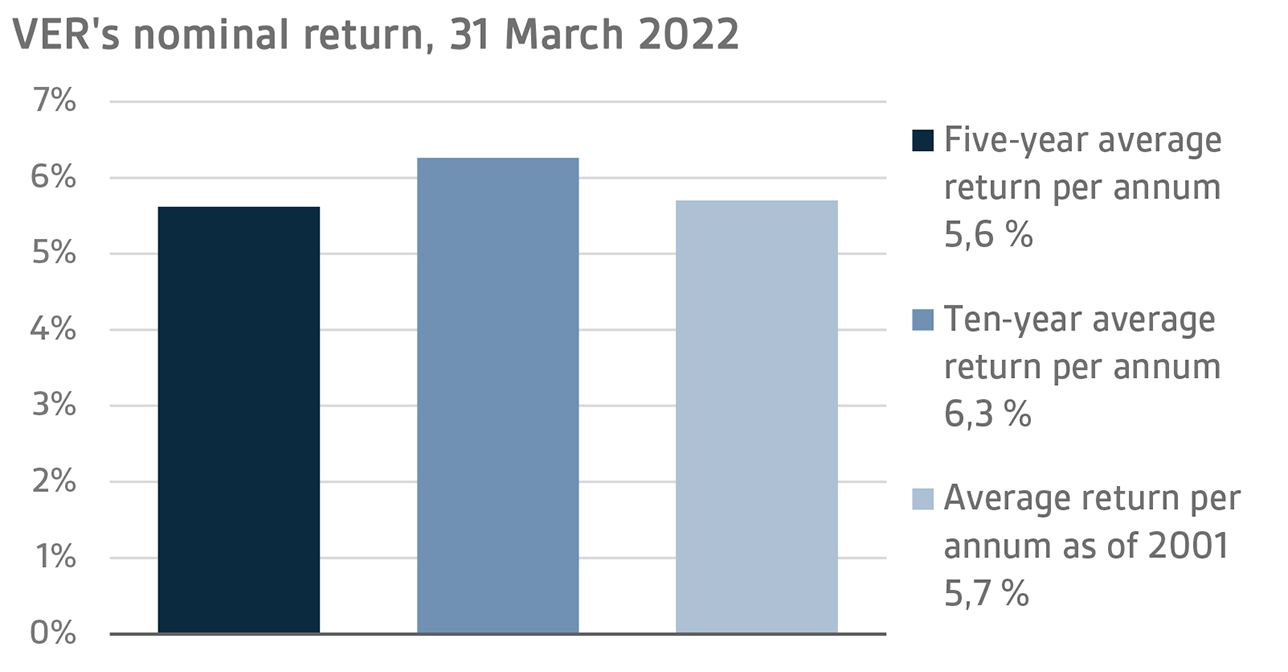

On 31 March 2022, VER’s investment assets totalled EUR 22.8 billion. During the first quarter, the return on investments at fair values was -3.0 per cent. The average nominal rate of return over the past five years (1 April 2017–31 March 2022) was 5.6 per cent and the annual ten-year return 6.3 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.7 per cent.

The real rate of return during the first quarter of 2022 was -6.0 per cent. VER’s five-year average real return was 3.6 per cent and ten-year real return 4.9 per cent. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 4.1 per cent.

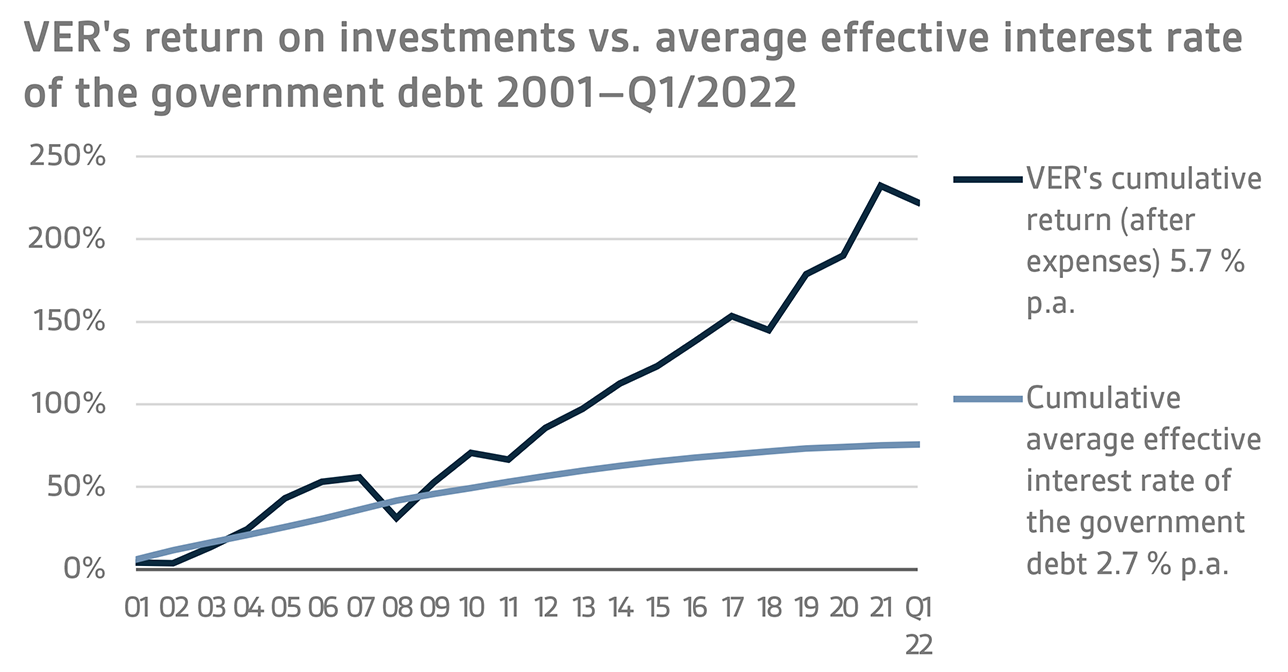

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 5.0 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 10.2 billion over the same period.

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged bonds is 50 per cent.

A CLOSER LOOK AT JANUARY–MARCH 2022

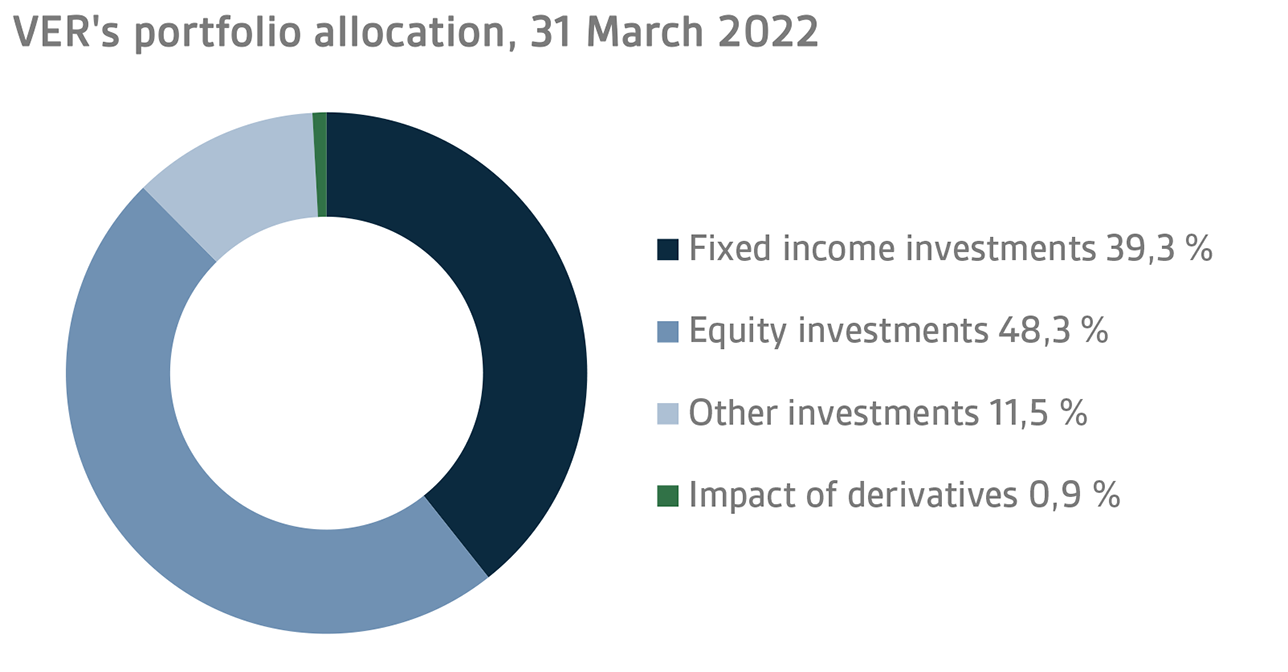

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of March, fixed income instruments accounted for 39.3 per cent, equities 48.3 per cent and other investments 11.5 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of -3.4 per cent and listed equities -5.3 per cent during the first quarter of the year.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

During the first quarter, the return on liquid fixed income was -3.4 per cent.

In January-March, inflation, the rise in interest rates and expectations of tighter monetary policies by central banks accelerated substantially since the turn of the year. Towards the end of February, the crisis in Ukraine caused a temporary drop in interest rates, especially for the supposedly safe government bonds, but otherwise the extremely high inflation rates and tightening monetary policy pushed up interest rates sharply and increased the spreads in risk premiums on corporate bond investments.

The US Federal Reserve began raising interest rates in March, increasing the refinancing rate by 25 basis points to 0.25-0.50%. At the same meeting, it revised up its forecast for future rate hikes significantly. Central bankers foresaw a median benchmark rate of 1.875% at the end of 2022 and 2.75% at the end of 2023. At the end of the quarter, the bond markets predicted an even faster rate of increase: around 2.50% by the end of 2022 and 3% by the end of 2023. Expectations of an imminent tightening of the monetary policy pushed up short-term rates in particular, with the result that the yield curve for US treasury bonds flattened or was even inverted.

In Europe, short-term interest rates in particular increased more modestly than in the United States. The European Central Bank continued to normalise monetary policy in March, although it kept its benchmark rates unchanged. Despite the uncertainty created by the situation in Ukraine, the ECB decided to reduce APP purchases at a faster pace than previously indicated in the wake of markedly higher inflation forecasts. While the ECB declined to comment on the likelihood of interest rate hikes in 2022, the bond market expects two 25-point increases during the year. The German ten-year government bond rate rose by more than 70 interest rate points to 0.54% in the first quarter.

As far as VER’s liquid fixed income investments are concerned, the increase in interest rates eroded returns on emerging market bonds in particular. Moreover, the returns generated by other fixed income asset classes were not that great, either, due to the increase in interest rates and growing spreads in risk premiums.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

The return on other fixed income investments was 0.4 per cent. Private credit funds returned 0.2 per cent and direct lending 1.3 per cent.

Although 2021 was dominated by Covid-19 news and a range of uncertainties in the economy, for the majority of private credit portfolio companies, the impact of interest rates on business operations was weaker and earnings performance was positive. The returns generated in the first quarter of the current year still reflect the sentiment prevailing at the end of the previous year, as the portfolio's return is based on updated year-end returns. However, 2022 started on an uncertain note and the change in market sentiment will also be reflected in the portfolios of private credit funds later in the year. The best performance will be put in by strategies that benefit from the uncertain market conditions.

EQUITIES

Listed equities

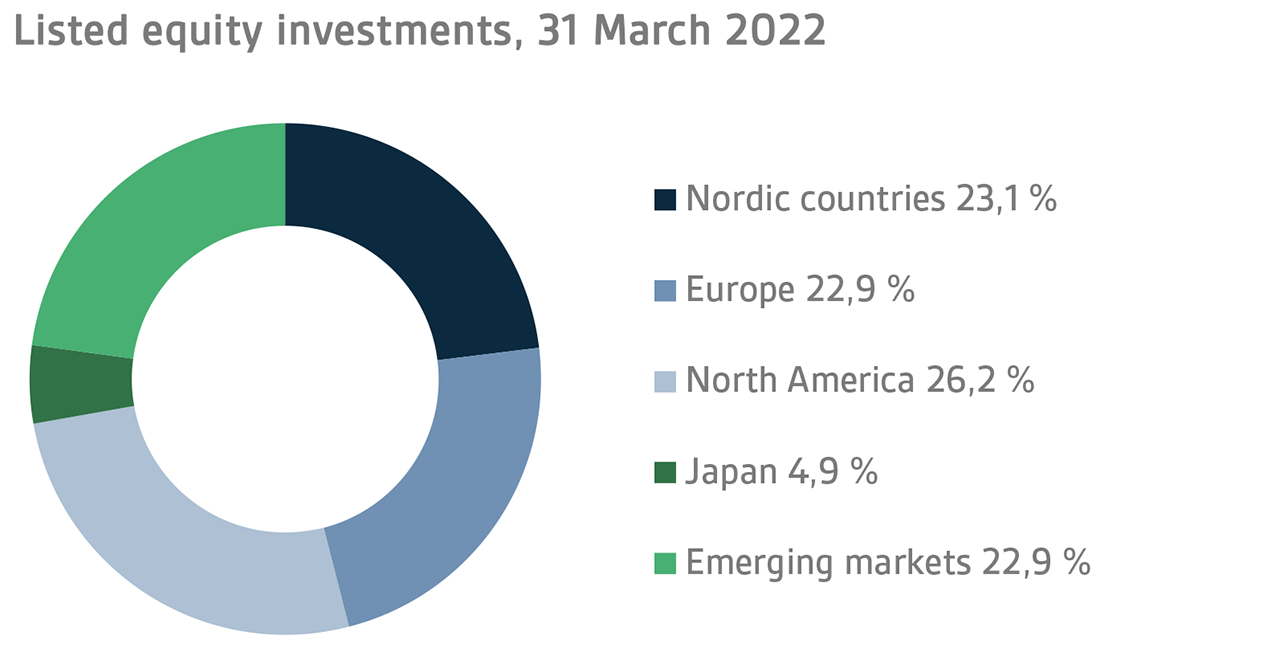

The return on listed equities during the first quarter of the year was -5.3 per cent.

The mood in the stock market at the beginning of 2022 was riddled with uncertainty. Share prices around the world started to fall right at the outset, and the first quarter of the year proved weak for equity investors, after a very strong performance in 2021. Many of the themes that failed to translate into investor optimism in 2021 resurfaced around New Year, but this time with different consequences. The biggest impact on first-quarter returns, however, came from the war in Ukraine, which led to a sharp fall in Nordic equities in particular. All sub-portfolios were in the red at the end of the first quarter.

When 2022 started, the mood was quite different from the previous year. While there were a number of main themes, inflation re-emerged as a key issue as we entered the new year. The inflation debate was given a new impetus by statistics showing that inflation is reaching very high levels around the world. Central banks were also compelled to revise theirs views on the temporary nature of the inflation, which sent interest rates up and caused jitters in the stock markets. Blue chip companies, particularly in the US, saw their share prices fall sharply as interest rates rose. Aside from inflation, a number of other old concerns tested investors’ faith in early 2022, the biggest of them being the continuation, and even intensification, of the Covid-19 pandemic around the turn of the year. By far the biggest and most disappointing event of the quarter, however, was the outbreak of war in Ukraine. The Russian invasion in late February also had far-reaching consequences for financial markets. Initially, the stock markets fell quite sharply, especially in Europe, but recovered somewhat during March. It is too early to assess the final impact of the war and the resulting sanctions on Russia on economic development. However, what is clear is that the effects will be substantial across the board, particularly for Europe due to the sharp rise in energy prices.

Other equity investments

VER’s other equity investments include investments in private equity funds, non-listed stock and listed real estate investment trusts (REITs).

Private equity investments returned 4.6 per cent and unlisted equities 5.9 per cent.

As in the past, the first-quarter returns on private equity funds are based on the updated values of the returns actually earned in the last quarter of the previous year. Indeed, 2021 was a record year for private equity funds, pushing first-quarter returns into a clearly positive territory. However, there has been a considerable change in the market sentiment in the early months of 2022, which will become apparent later in the spring when actual first-quarter earnings for the year are updated.

OTHER INVESTMENTS

VER’s other investments are investments in real estate, infrastructure, hedge funds and risk premium strategies.

The return on unlisted real estate funds was 1.5 per cent while infrastructure investments yielded 4.9 per cent.

The first-quarter returns on properties were still affected by those earned in the last quarter of 2021. Demand for premium properties has remained high in the real estate market, both in Finland and internationally. The logistics sector, in particular, has put in an impressive performance during the first few months of 2022. However, rising inflation and the declining situation in Europe will continue to be reflected in the real estate market.

The first-quarter returns on infrastructure funds represent returns actually earned in the last quarter of the previous year. The main drivers of returns are successful exits and rising valuation levels of companies. A substantial part of VER's infrastructure portfolio consists of so-called core infrastructure assets, which have generally performed well during the Covid-19 crisis.

Hedge funds and systematic strategies returned 1.1 per cent in the first quarter.

Hedge funds managed to do well earning positive returns in an environment where traditional asset classes generated negative returns. An exceptionally good performance was put in by quantitative funds and macro funds concentrating on advanced markets. Negative returns were only generated by funds focusing on the Asian markets. For systematic strategies, returns were negative in the first few months of the year, mainly because short-term momentum models performed poorly in a turbulent market environment.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The role of the State Pension Fund in equalising the government’s pension expenditure continues to grow. In 2021, the state’s pension expenditure totalled over EUR 4.8 billion while the 2022 budget foresees an expenditure of nearly EUR 4.9 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2022 budget will amount to about EUR 1.9 billion.

During the first quarter, VER transferred EUR 500 million to the government budget. Over the same period, VER’s pension contribution income totalled EUR 377 million. The pension contribution income matched the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

Progress was made during the reporting period in drafting the new act on the State Pension Fund. The Government submitted its proposal to Parliament in early February and the Act was adopted by Parliament in March. The new law will be effective as of 8 April 2022. A key amendment is an increase in the government budget transfer from 40% to 45%, to be phased in during 2024–2028. In addition, if VER's funding rate rises above 25% for two consecutive calendar years, an additional 3% transfer will be made until the funding rate falls below 25%. As the State’s pension liabilities amounted to EUR 93.3 billion at the end of 2021, the funding ratio was approx. 25.4 per cent. VER will assess the exact impact of the amendment on VER's strategy and investment planning during 2022.